Picture this: You’re scrolling through TikTok when you see someone your age methodically counting out crisp bills and stuffing them into rainbow-colored envelopes. Your first thought? “That’s so extra.” Your second thought? “Wait, why do they look so… financially stress-free?”

Welcome to the wild world of cash stuffing – the budgeting method that has led 28% of millennials and Gen Z to abandon their beloved tap-to-pay apps in favor of good old-fashioned paper money.

I know what you’re thinking. In 2025, when we can buy coffee with our smartwatches and split dinner with Venmo, why are young people suddenly acting like it’s 1925? Here’s the kicker: they’re saving thousands of dollars doing it.

Let me tell you why this isn’t just another TikTok trend that’ll disappear faster than your paycheck after rent.

The $27,000 Problem That Started It All

Here’s a number that’ll make your stomach drop: the average millennial carries $27,251 in non-mortgage debt.

Credit cards? We’re talking $6,932 per person. And get this – that number jumped 50% between 2022 and 2024. Meanwhile, housing costs are double what our parents paid at our age.

But here’s where it gets interesting. Despite drowning in debt, millennials are also the generation saving the most money – averaging $12,005 per person in 2024. We’re living this weird financial contradiction where we’re both broke and responsible, stressed about money but still grabbing that $7 latte.

Sound familiar? That’s because we’ve been conditioned to spend money we can’t see.

Your Brain on Plastic: Why Credit Cards Are Addictive

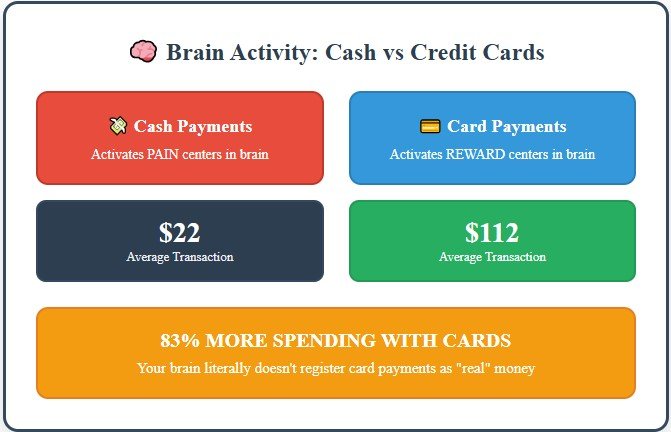

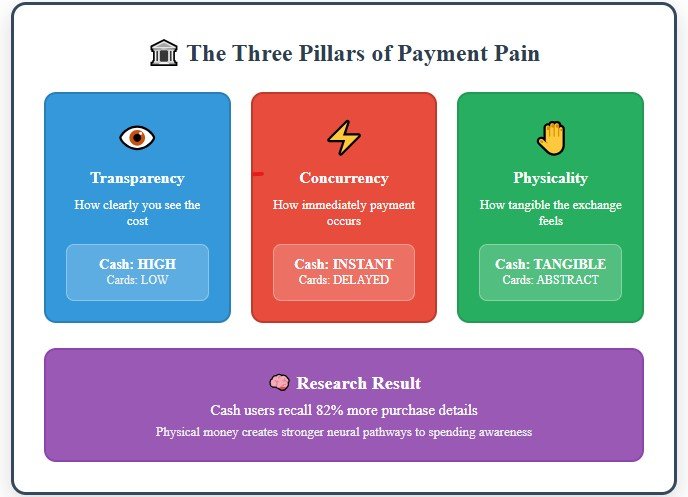

Ready for some mind-blowing science? Researchers at MIT did something wild – they put people in brain-scanning machines and watched what happened when they made purchases.

When someone used cash, their brain lit up in the same area that processes physical pain. Seriously. Handing over a $20 bill hurts your brain the same way stubbing your toe does.

But when they swiped a credit card? The pain center went quiet, and instead, their brain’s reward system started firing like they’d just eaten chocolate or won the lottery.

This is why people spend 83% more with credit cards than with cash. Your brain doesn’t register card payments as “real” spending.

Think about it. When’s the last time you remember exactly how much you spent at Target? If you used your card, you probably never. But if you’d counted out three $20 bills, you’d remember that $60 forever.

Meet the Cash Stuffing Millionaires (Yes, Really)

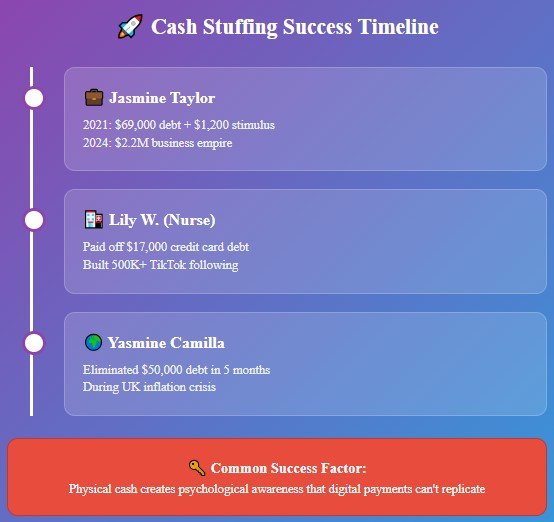

Let me introduce you to Jasmine Taylor. Two years ago, she was drowning in $69,000 of debt with a credit score in the dumps. Today? She runs a $2.2 million business teaching people to stuff cash into envelopes.

Her secret weapon wasn’t some complex investment strategy or crypto scheme. She started with a $1,200 stimulus check and a stack of Dollar Tree envelopes.

Or take Lily, a 22-year-old nurse who paid off $17,000 in credit card debt using nothing but cash and envelopes. She discovered cash stuffing during a financial crisis and now has over 500,000 TikTok followers watching her budget.

These aren’t lottery winners or trust fund babies. They’re regular people who figured out something your great-grandmother knew: when you can see your money, you spend less of it.

What Exactly Is Cash Stuffing? (The Grandma Method Goes Viral)

Cash stuffing is basically the envelope method your great-grandmother used during the Great Depression, but with better lighting and more colorful envelopes.

Here’s how it works:

Step 1: You withdraw cash for your monthly spending categories. Step 2: You stuff that cash into labeled envelopes (groceries, gas, entertainment, etc.) Step 3: When an envelope is empty, you stop spending in that category

That’s it. No apps, no spreadsheets, no complicated formulas.

The genius is in the limitations. When your “eating out” envelope has $40 left and you want a $35 dinner, you see exactly what that choice costs. With a credit card, that same decision feels weightless.

Why This Old-School Method Is Perfect for Our Digital Chaos

You might be wondering: “Why go backwards when we have budgeting apps?”

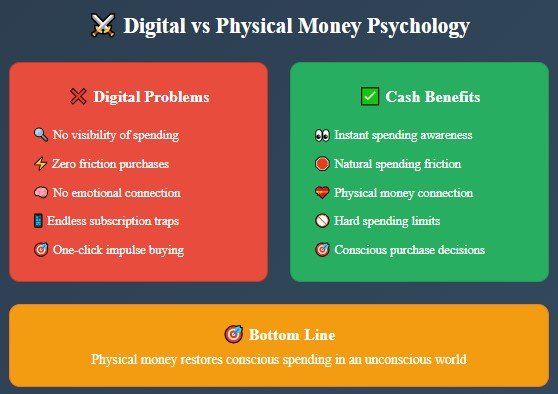

Because apps don’t create emotional connections to spending. You can blow through $200 on random purchases, and your app will dutifully track every transaction. But tracking isn’t the same as feeling.

Cash stuffing works because it makes your money finite and visible. Instead of checking an app to see if you can afford something, you check your envelope. The answer is either there in green paper or it’s not.

Plus, let’s be honest – how many budgeting apps have you downloaded, used for two weeks, then forgotten about? I’m guessing more than you’d like to admit.

The Psychology That Makes Your Wallet Lighter

Remember when McDonald’s switched from “Would you like to supersize that?” to “Would you like to make that a large?” Sales dropped significantly. Why? The word “supersize” made people think about excess.

Language matters. Visibility matters. Friction matters.

Digital payments remove all three. When you tap your phone to buy something, there’s no language around money, no visibility of what you’re spending, and no friction to make you think twice.

Cash stuffing restores all of that. You have to physically count money, see your envelope getting thinner, and feel the friction of every purchase.

Dr. Dan Ariely from Duke University puts it perfectly: “As we embrace a more digitalized spending economy where transactions can be made seamlessly, it’s important for consumers to add friction and increase their ‘pain of purchase.'”

Getting Started: Your First Month of Cash Stuffing

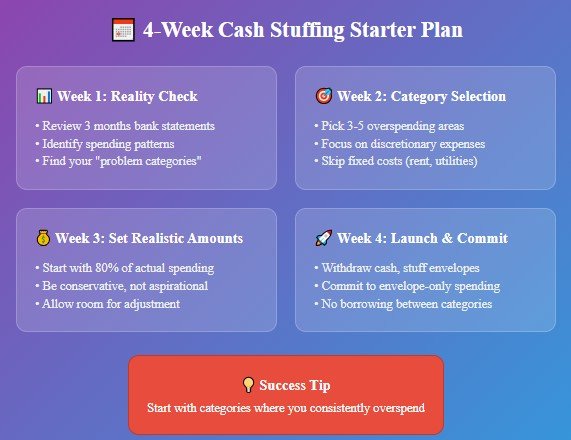

Ready to try this? Don’t go crazy and try to cash-stuff your entire life on day one. That’s the fastest way to give up.

Week 1: The Reality Check. Pull up your last three months of bank statements. Yes, all of them. Look for patterns in your spending. Where does your money go? (Spoiler alert: it’s probably not where you think.)

Week 2: Pick Your Problem Categories. Choose 3-5 categories where you consistently overspend. Common ones are:

- Groceries

- Dining out

- Entertainment

- Gas

- Personal care/shopping

Don’t try to put rent or utilities in envelopes. Keep your fixed expenses digital – we’re not trying to pay the mortgage with a stack of twenties.

Week 3: Set Conservative Amounts. Here’s where most people mess up. They set aspirational amounts instead of realistic ones. If you spent $600 on groceries last month, don’t suddenly budget $300. Start with $550 and see how it feels.

Week 4: The Test Run. Withdraw your cash, stuff your envelopes, and commit to one month. When an envelope is empty, you’re done spending in that category. No borrowing from other envelopes, no “emergency” card swipes.

The Mistakes That Kill Your Cash Stuffing Dreams

Mistake #1: Going All-In Too Fast. I’ve seen people try to manage their entire financial life through envelopes. Don’t. Start small and expand gradually.

Mistake #2: Making It Instagram-Perfect. Those TikTok videos with perfectly organized bills and color-coordinated envelopes? Pretty, but unnecessary. Wrinkled fives work just as well as crisp hundreds.

Mistake #3: Playing Musical Envelopes When your restaurant money runs out, resist the urge to “borrow” from your grocery envelope. The whole point is having boundaries.

Mistake #4: Ignoring Security Cash offers zero insurance protection. Invest in a fireproof safe and never carry large amounts. Your financial goals aren’t worth getting robbed over.

Blending Old School with New School

The most successful cash stuffers aren’t anti-technology – they’re strategic about it.

Digital Envelope Apps like YNAB and Goodbudget give you the envelope psychology with bank-level security. You get the mental boundaries without the physical cash risks.

Hybrid Approaches work great too. Use cash for problem spending categories and keep everything else digital. The goal is awareness, not suffering.

Bank Sub-Accounts let you create “virtual envelopes” within your existing accounts. Many banks now offer this feature specifically because envelope budgeting works so well.

The Real Reason This Trend Matters

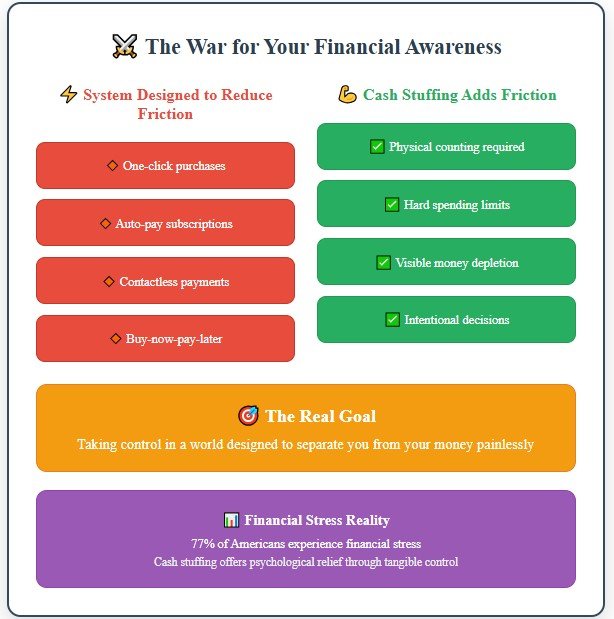

Cash stuffing isn’t really about cash. It’s about taking control in a world designed to separate you from your money as painlessly as possible.

Every app, every payment method, every “convenience” in our financial system is engineered to reduce spending friction. One-click purchases, auto-pay subscriptions, contactless payments – they all share the same goal: making spending feel effortless.

But effortless spending leads to mindless spending. And mindless spending leads to debt, stress, and those 3 AM panic attacks about your bank balance.

Cash stuffing is a rebellion against financial automation. It’s choosing to feel the weight of your spending decisions instead of floating through them unconsciously.

Your Next Money Move

Here’s what I want you to do right now:

- Pick one spending category where you consistently blow your budget

- Calculate how much you spent there last month (check your bank app)

- Withdraw 80% of that amount in cash this weekend

- Put it in an envelope (literally any envelope works)

- Use only that cash for that category this month

That’s it. No complicated systems, no perfect planning, no waiting for Monday to start. Just one envelope, one category, one month.

See what happens to your awareness. Notice how differently you think about purchases when you have to count out bills. Pay attention to how your spending habits change when your money has limits.

The Bottom Line

Your great-grandmother was onto something. In a world where money has become increasingly abstract – just numbers on screens and plastic in wallets – making it physical again creates a psychological shift that apps can’t replicate.

You don’t have to become a cash-only zealot or reject all financial technology. But if you’re tired of wondering where your money goes every month, if you’re stressed about debt, or if you just want to feel more in control of your finances, maybe it’s time to stuff some cash in an envelope.

After all, the worst thing that happens is you save some money. And judging by the thousands of success stories flooding social media, that’s exactly what’s going to happen.

Ready to give it a try? Your future self (and your bank account) will thank you.