Have you ever created the perfect budget, followed it religiously for about three weeks, then somehow found yourself at Target with a cart full of things you “definitely needed”?

You’re not alone. 74% of Americans admit to having overspending problems, yet here’s the kicker – traditional budgeting advice might be making things worse.

I know, I know. That sounds crazy. We’ve been told our whole lives that detailed budgeting is the golden ticket to financial freedom. Track every penny! Know where every dollar goes! Create seventeen different categories for your spending!

But what if I told you that Nobel Prize-winning research suggests the complete opposite? What if the secret to controlling your spending isn’t more complexity, but dramatically less?

Welcome to the world of “bare minimum” budgeting – where doing less actually gets you better results.

Why Your Detailed Budget Is Sabotaging Your Success

Let’s start with an uncomfortable truth: your brain wasn’t designed to handle modern budgeting.

Think about it. Your ancestors didn’t need to track whether that mammoth hunt expense should go under “Food” or “Entertainment.” They had simple rules: find food, avoid predators, don’t freeze to death.

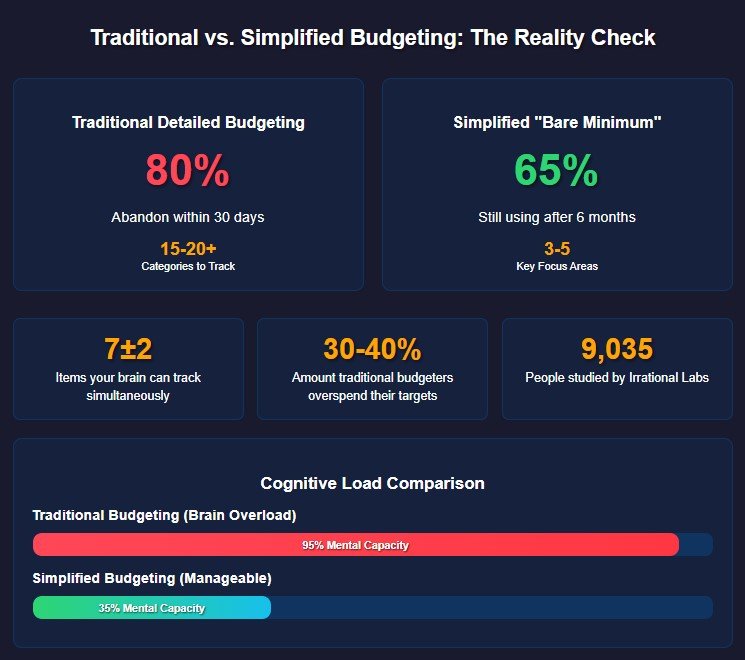

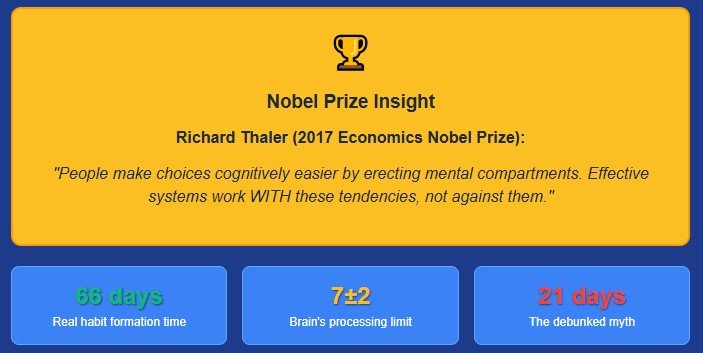

Your working memory can only handle about 7±2 pieces of information at once. Yet the average budgeting app wants you to track 15-20+ categories. It’s like trying to juggle while riding a unicycle – technically possible, but why would you torture yourself?

Here’s where it gets really interesting. A massive study by Irrational Labs tracked over 9,000 people who tried traditional budgeting. The shocking result? Traditional budgeters showed no significant difference in spending behavior compared to people who didn’t budget at all.

Even worse, when budgeters did track their spending, they typically overspent their intended amounts by 30-40%. The budget became a license to spend rather than a guardrail to protect them.

The Psychology Behind Why “More Information” Backfires

Then you’re standing in line at Starbucks, and your budgeting app starts buzzing. “You’ve spent $47 of your $50 coffee budget this month!” Now you have to decide: Is this purchase worth it? Which category should it go in? Should you skip it and feel deprived, or buy it and feel guilty?

This is called decision fatigue, and it’s why your willpower crashes by afternoon.

Dr. Dan Ariely from Duke University puts it perfectly: “We consistently make poor financial decisions in predictable ways.” The problem isn’t that you’re weak-willed. The problem is that you’re human, and humans have cognitive limitations.

MIT research reveals something even more surprising: people who track their spending with apps spend MORE money than those who track by memory alone. Why? Because precise budget information makes you more confident about what you can afford, leading to increased spending, especially toward the end of your budget period.

It’s like knowing exactly how much gas is in your tank makes you more likely to take that longer route home.

The “Bare Minimum” Revolution: Less Is More

So what’s the alternative? Enter bare minimum budgeting – a radically simplified approach that works with your brain instead of against it.

The core principle is beautiful in its simplicity: Instead of tracking where every dollar goes, you control where the most important dollars go first.

Richard Thaler won the Nobel Prize in Economics for proving that people naturally create mental compartments for money. Effective budgeting systems work with these tendencies, not against them.

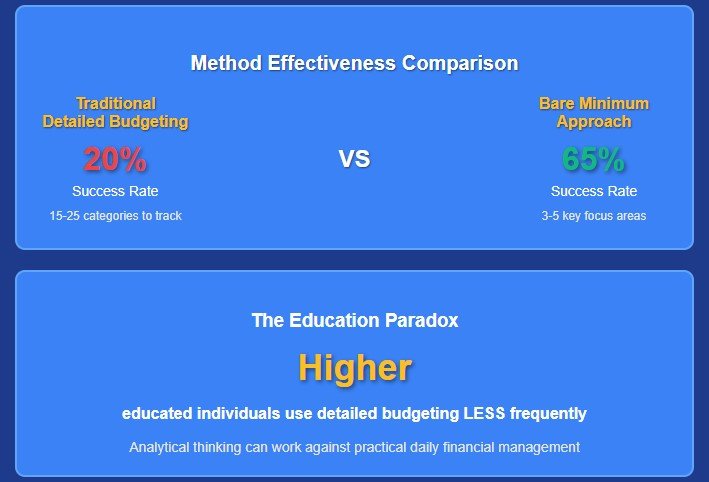

Here’s the thing that might blow your mind: highly educated individuals use detailed budgeting less frequently than others. Why? Because analytical thinking can work against practical daily financial management. Sometimes, less thinking leads to better results.

Method #1: The “Pay Yourself First” Game-Changer

This is the method that transformed my relationship with money, and it’s embarrassingly simple.

Step 1: Automatically transfer 10-20% of your income to savings the moment you get paid.

Step 2: Pay your fixed expenses (rent, utilities, minimum debt payments).

Step 3: Spend whatever’s left without guilt or detailed tracking.

That’s it. No categories. No complex spreadsheets. No daily decision fatigue.

Kumiko Love, known as The Budget Mom, used this approach to pay off over $77,000 in debt in less than a year after failing with traditional monthly budgets. Her key insight? “You can’t address your debt until you know how to make your money work for you.”

The psychology is brilliant. By saving first, you remove temptation. The money is gone before you can spend it. What remains is truly available for spending, which eliminates the guilt and constant mental math.

Method #2: The Weekly Envelope Hack

Remember when your grandmother used actual envelopes with cash for different expenses? She was onto something neuroscience is just now proving.

Jenny Groberg used a modern version of envelope budgeting to pay off $250,000 in student loans in just two years. Her secret? Weekly allocations instead of monthly ones.

Here’s how it works:

Each week, put money into physical or digital “envelopes” for your main spending areas:

- Groceries: $150/week

- Entertainment: $75/week

- Personal spending: $50/week

When an envelope is empty, you’re done spending in that category until next week. Simple boundaries that your brain can follow.

The weekly timing is crucial. Monthly budgets fail because most people overspend in the first two weeks, then feel deprived for the remaining two weeks. Weekly resets keep you from falling too far behind.

Method #3: The “Anti-Budget” That Works

The Anti-Budget Automation System

Success rate with manual financial management

Success rate with automated financial systems

The Power of Automation

Ramit Sethi – “I Will Teach You to Be Rich”

“Remove human decision-making from your most critical financial choices, then spend freely on everything else.”

This might be the most controversial approach, but stick with me.

Ramit Sethi, author of “I Will Teach You to Be Rich,” advocates for what he calls “anti-budgeting.” The philosophy? Remove human decision-making from your most critical financial choices, then spend freely on everything else.

Here’s the framework:

- Automate savings (20% of income)

- Automate fixed expenses

- Automate debt payments

- Spend whatever remains without tracking

No categories. No apps. No daily decisions. Just automated systems handling the important stuff while you live your life.

People with automatic savings plans are twice as likely to save successfully compared to manual savers. The math is simple: humans are unreliable, but systems are consistent.

The Surprising Research That Changes Everything

Ready for some mind-bending statistics that flip conventional wisdom on its head?

Optimistically low budgets outperform “realistic” ones. University of Virginia research shows that people who set knowingly low budgets (and exceed them) spend less overall than those who set “achievable” targets.

If you usually spend $500 on restaurants, setting a $250 budget and spending $350 results in less total spending than setting a $400 “realistic” budget. Your brain treats the lower number as an anchor, even when you exceed it.

Credit cards make spending feel like it costs only 50 cents per dollar. MIT studies show people bid twice as much for identical items when paying with credit versus cash. The “pain of paying” with plastic is roughly half that of physical money.

And here’s the kicker: the 21-day habit myth is completely false. University College London research shows that financial habits actually take an average of 66 days to form, with a range of 18-254 days. Most people abandon budgeting systems within the first month, well before real habit formation occurs.

Why Your Brain Loves Simple Systems

Your Brain on Budgeting: Simple vs Complex

• Constant decision fatigue

• High abandonment rate

• Automated decisions

• Sustainable long-term

Working Memory Limit: 7±2 Items

The Financial Stress Impact

Why Simple Systems Win

The Neuroscience Bottom Line

When saving is automatic and spending boundaries are clear, your brain can focus on enjoying life instead of constantly calculating whether you can afford it.

Your brain is constantly looking for ways to conserve energy. Complex budgeting systems drain mental resources that could be used for more important decisions.

Financial stress creates measurable cognitive impairment. Princeton research found that financial worry reduces cognitive function equivalent to losing 13 IQ points or missing an entire night’s sleep. When you’re stressed about money, you literally can’t think as clearly.

Simple systems reduce this cognitive load. When saving is automatic and spending boundaries are clear, your brain can focus on other things. Like enjoying your life instead of constantly calculating whether you can afford it.

The 66-Day Challenge: Building Your Bare Minimum System

Forget 21 days. Real habit formation takes 66 days on average. Here’s your progressive plan:

Days 1-7: Set Up Automation

- Automate your savings transfer

- Automate fixed bills

- Choose your spending tracking method (if any)

Days 8-21: Find Your Rhythm

- Adjust automation amounts if needed

- Notice your spending patterns without judgment

- Celebrate small wins

Days 22-44: Handle the Wobbles

- You’ll want to quit around day 18. This is normal.

- Missing one day doesn’t ruin everything

- Focus on consistency, not perfection

Days 45-66: Lock It In

- Fine-tune your system

- Plan for irregular expenses

- Start seeing real results

Real Talk: Addressing Your Objections

“But I need to know where my money goes!”

Fair point. Once your savings and fixed expenses are automated, do a quarterly review. Look at three months of spending and identify the big patterns. You don’t need daily tracking for this insight.

“What about irregular expenses?”

Set aside monthly amounts for annual bills, car repairs, and gifts. If your car insurance costs $600 annually, save $50 monthly. Simple math, no surprises.

“This seems too simple to work.”

That’s exactly why it does work. Popular personal finance advice consistently contradicts economic theory, according to Yale professor James J. Choi’s analysis of the 50 most popular finance books. The “wrong” advice often works better due to psychological factors.

Your Next Steps: From Overwhelmed to In Control

Here’s what you’re going to do today:

- Calculate 20% of your monthly income. This is your automatic savings amount.

- Set up automatic transfers for this amount to happen the day after payday.

- List your fixed monthly expenses. Rent, utilities, minimum debt payments, and insurance.

- Choose ONE simple tracking method: Weekly envelopes, the 50/30/20 rule, or pure anti-budgeting.

- Give yourself 66 days to let the system become automatic.

Remember, the goal isn’t perfection. It’s progress. It’s reducing the mental energy you spend on money decisions so you can focus on the things that actually matter to you.

The Bottom Line: Less Is More

After decades of being told that detailed budgeting is the only path to financial success, this might feel uncomfortable. But the research is clear: simplified approaches succeed not despite their lack of detail, but because of it.

Your brain has cognitive limitations. Traditional budgeting ignores these limitations and sets you up for failure. Bare minimum budgeting works with your psychology, not against it.

The most successful people don’t spend their days tracking every coffee purchase. They set up systems that handle the important stuff automatically, then move on with their lives.

You don’t need perfect budgeting. You need a system that’s simple enough to actually follow for the long haul.

Ready to try the bare minimum approach? Start with just one automated savings transfer this week. Your future self will thank you for keeping it simple.

What’s your biggest budgeting challenge? Have you tried simplified approaches before? Share your experience in the comments below – your story might help someone else finally take control of their finances.