Your neighbor just locked in a 5% savings rate while you’re stuck paying 6.8% on your mortgage. Sound unfair? Welcome to 2025’s bizarre financial reality, where the Federal Reserve’s interest rate decisions have created the most lopsided playing field in decades.

If you’ve been scratching your head wondering why your mortgage payments feel crushing while your friend brags about their savings account earnings, you’re not alone. The Fed’s current strategy has essentially split Americans into two camps: those winning big and those getting squeezed hard.

Here’s what’s happening behind the scenes – and more importantly, what you can do about it.

Why Your Mortgage Still Hurts (Even After Rate Cuts)

Let’s start with some tough love: those Federal Reserve rate cuts everyone celebrated? They barely helped your mortgage situation.

The Fed cut rates three times in late 2024, dropping them a full percentage point to the current 4.25-4.5% range. You’d think that would make mortgages cheaper, right? Wrong.

Here’s the kicker: 30-year mortgage rates are still sitting around 6.8% – barely budging from their peaks. That’s because mortgages don’t follow the Fed’s rate. They follow 10-year Treasury bonds, which have their agenda.

Think of it like this: the Fed controls the thermostat in the basement, but your mortgage lives on the second floor. The temperature upstairs? That depends on a lot more than just the basement setting.

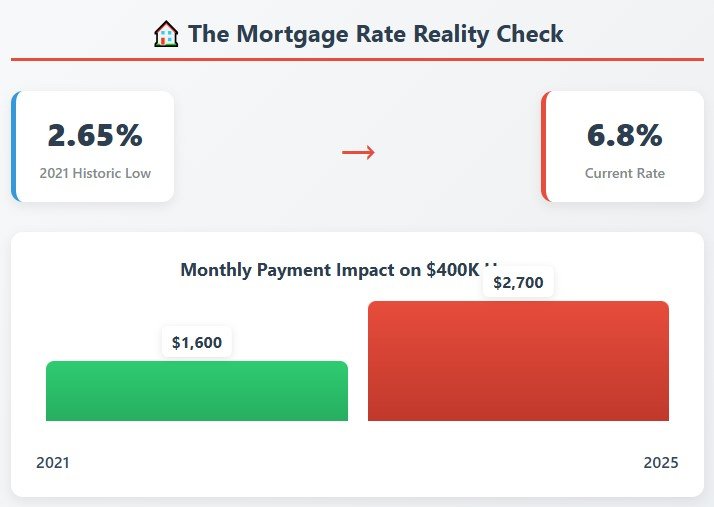

The Real Numbers That’ll Make You Wince

Want to see how wild this market has gotten? Mortgage rates have jumped 158% since 2021’s rock-bottom 2.65% rates. That means if you bought a $400,000 house back then, your monthly payment was about $1,600. Buy that same house today? You’re looking at $2,700 a month.

Even worse, you now need a household income of $147,433 just to afford the median-priced home of $459,826. Only 31.5 million American households even qualify – and that’s assuming they have perfect credit and a solid down payment.

But here’s the part that’ll blow your mind: 82% of current homeowners have mortgage rates below 6%. They’re essentially trapped in their homes because moving would mean trading their sweet 3% rate for today’s brutal 6.8%.

Why Homeowners Are Playing Real Estate Musical Chairs

This has created what economists call the “lock-in effect,” but I like to think of it as financial musical chairs. Nobody wants to give up their seat (low mortgage rate) because they know they’ll never find another one that good.

The result? Existing home sales have crashed to 30-year lows. We’re talking 4.03 million homes sold annually versus the usual 5+ million. It’s not that people don’t want to move – they literally can’t afford to.

Fed Chair Jerome Powell basically admitted the Fed painted itself into a corner. In July 2025, he said they had to pause rate cuts because of tariff uncertainty. Translation: trade wars are messing with their ability to help you with your mortgage.

Meanwhile, Savers Are Living Their Best Life

Now for the plot twist that nobody saw coming: if you’ve got money sitting around, you’re probably doing better than you have in 15 years.

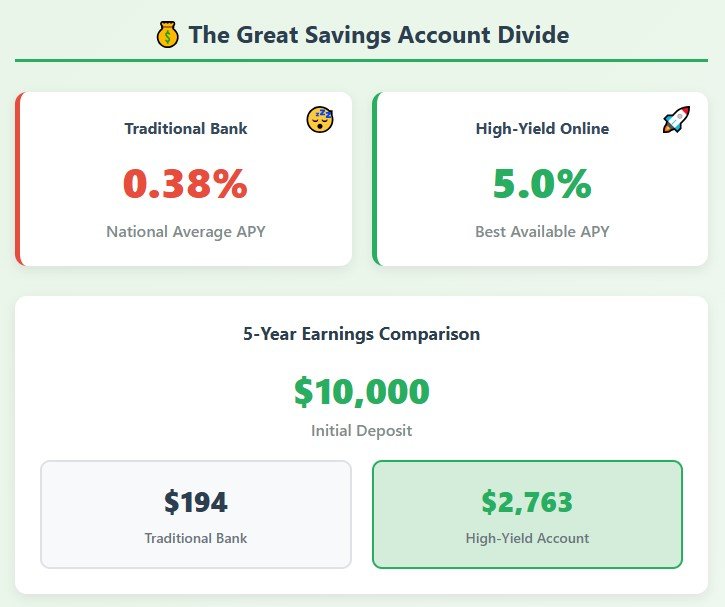

Remember when savings accounts paid nothing? Those days are long gone. Top high-yield savings accounts are now paying 4.5% to 5% annually. That’s not a typo – we’re talking about real money.

Let’s put this in perspective: park $10,000 in a high-yield account earning 4.5%, and you’ll make $4,483 more over five years compared to leaving it in a traditional bank account. That’s real money that could cover a vacation, emergency fund, or down payment boost.

The Savings Account Gold Rush

Here’s what most people don’t realize: you’re losing money every day your cash sits in a traditional bank account. The national average savings rate is a pathetic 0.38%, while inflation runs around 2.4%. That means your money is shrinking in real purchasing power.

But switch to a high-yield account? You’re not just keeping up with inflation – you’re beating it by a solid margin.

The top players right now:

- Varo Money: 5.00% APY

- Axos Bank: 4.66% APY

- Various credit unions and online banks: 4.5%+

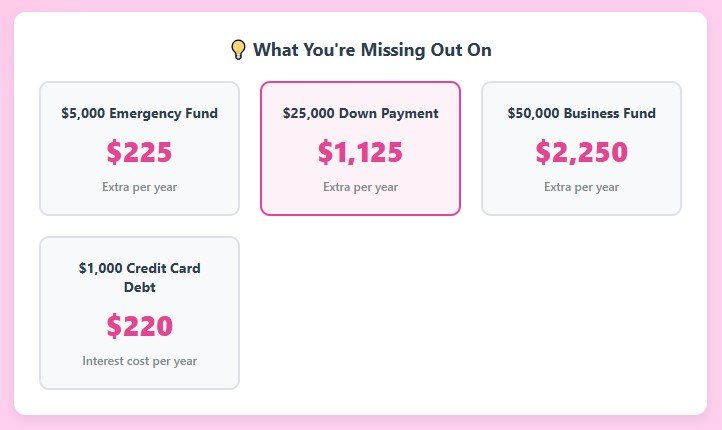

The math is simple: $25,000 in a high-yield account earns you about $1,125 more per year than keeping it at your local bank. That’s a car payment, half your property taxes, or a nice chunk of your grocery budget.

The Generation Game: Who’s Winning?

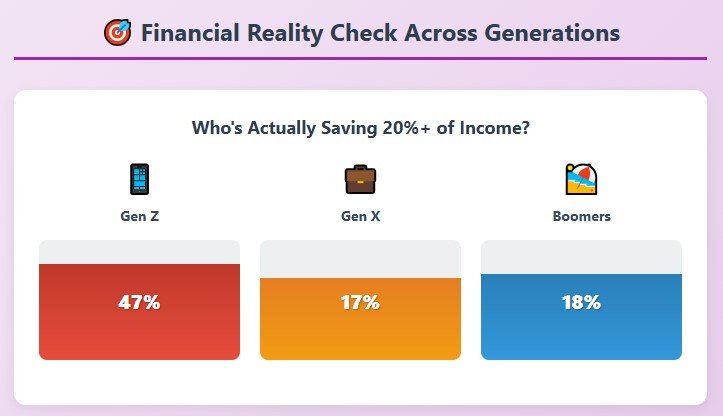

Here’s where things get interesting. All those stereotypes about young people being financially irresponsible? Completely wrong.

Generation Z is now saving more than 20% of their income – 47% of them, to be exact. Compare that to only 18% of boomers and 17% of Gen X hitting that savings rate. The kids are alright, financially speaking.

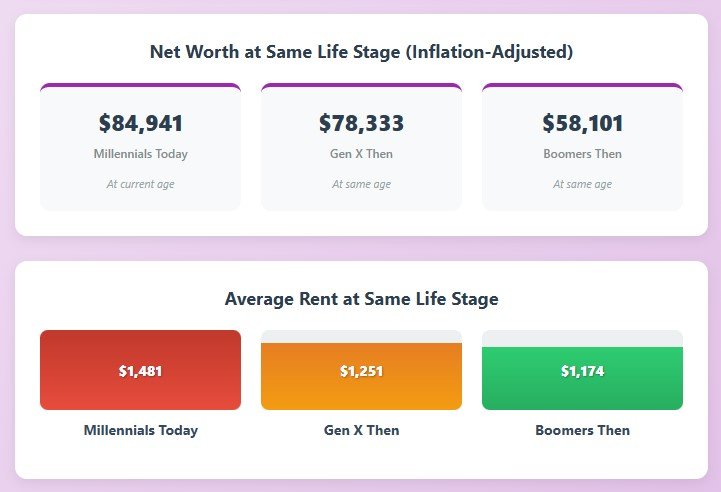

But here’s the cruel irony: millennials now have higher net worth than previous generations had at their age ($84,941 median), but they’re paying way more for housing. We’re talking $1,481 average rent versus $1,251 for Gen X and $1,174 for boomers at the same age.

Boomers Are Spending Like It’s 1999

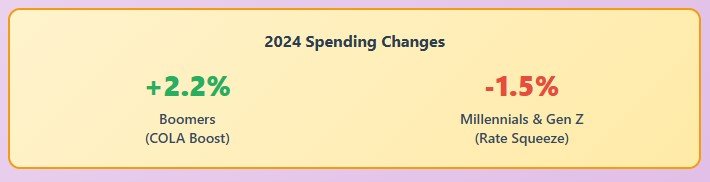

Meanwhile, baby boomers increased their spending by 2.2% in 2024 while younger generations cut back by 1.5%. Why? The largest Social Security cost-of-living adjustment in 40 years – a whopping 8.7% boost.

Talk about timing. Boomers are getting inflation adjustments while working-age Americans deal with higher borrowing costs and housing prices. It’s like showing up to a party just as they’re serving the good appetizers.

The Sneaky Ways This Affects Your Daily Life

You might think interest rates only matter for big purchases, but they’re quietly reshaping how you spend money every day.

Credit card debt hit $1.18 trillion in 2025 and grew 6% year-over-year, even with rates above 20%. That tells us something important: people are prioritizing immediate needs over borrowing costs. But that’s a dangerous game.

Here’s a reality check: every $1,000 you carry on a credit card at 22% interest costs you $220 per year just in interest payments. That’s $18 a month you’re paying for the privilege of owing money.

The Business World Feels It Too

This isn’t just about your finances. Business loan rates now average 6.5-7.1% depending on your location, with rural businesses often paying more. That means fewer business expansions, fewer new hires, and ultimately fewer opportunities for everyone.

Small businesses are especially squeezed. They can’t refinance their way out of higher rates like homeowners with locked-in mortgages. They’re stuck paying current market rates on everything.

What Smart Money Moves Look Like Right Now

Enough doom and gloom – let’s talk strategy. This weird rate environment has created some genuine opportunities if you know where to look.

The High-Yield Savings Arbitrage

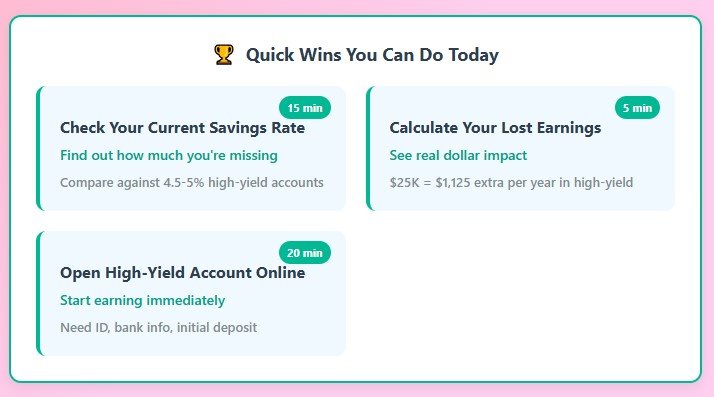

This is the easiest money you’ll ever make. Moving your emergency fund from a traditional bank to a high-yield account is free money. No risk, no complexity, just better returns.

The process takes about 15 minutes online. You’ll need your ID, bank account info, and maybe an initial deposit. Within a week, you’re earning 10-15 times more on your money.

CD Laddering Makes a Comeback

Remember certificates of deposit? They’re useful again. Top CDs are paying 4.5-4.6% for terms as short as 3-6 months.

Here’s the smart play: instead of putting all your money in one long-term CD, create a “ladder.” Put some money in a 3-month CD, some in a 6-month, and some in a 12-month. When each one matures, you can decide whether to renew or move to something better.

Debt Paydown as an Investment

With credit cards charging 20%+, paying off high-interest debt gives you a guaranteed 20% return. Show me an investment that beats that with zero risk. You can’t.

If you’ve got both credit card debt and money in savings earning 4%, you’re essentially borrowing at 20% to lend at 4%. That’s a losing proposition every day of the week.

The Geographic Lottery Nobody Talks About

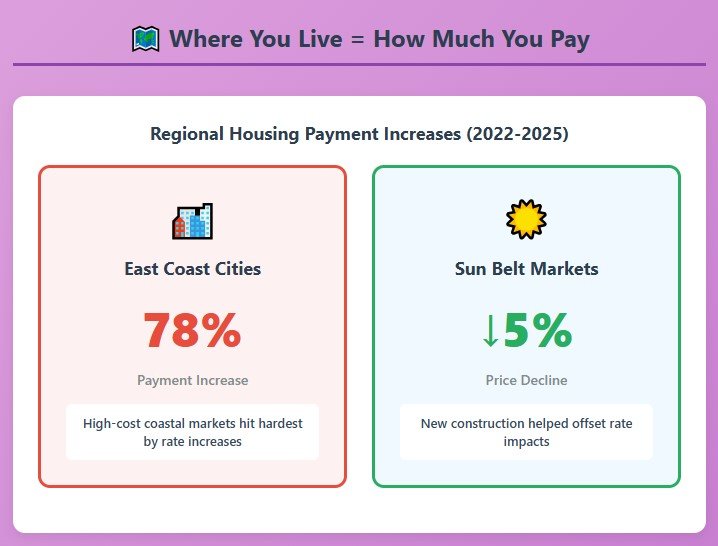

Where you live matters more than ever. East Coast homebuyers faced up to 78% increases in monthly payments from 2022-2025, while some Sun Belt markets saw prices decline.

This isn’t just about the cost of living anymore. It’s about access to financial opportunities. Some regions have better high-yield savings options, different business lending rates, and varying housing market dynamics.

The research shows interest rate changes create “spatial polarization” – basically, some cities get hit way harder than others when rates move. If you’re in a high-cost coastal city, you’re feeling this more acutely than someone in the Midwest.

What’s Coming Next (And How to Prepare)

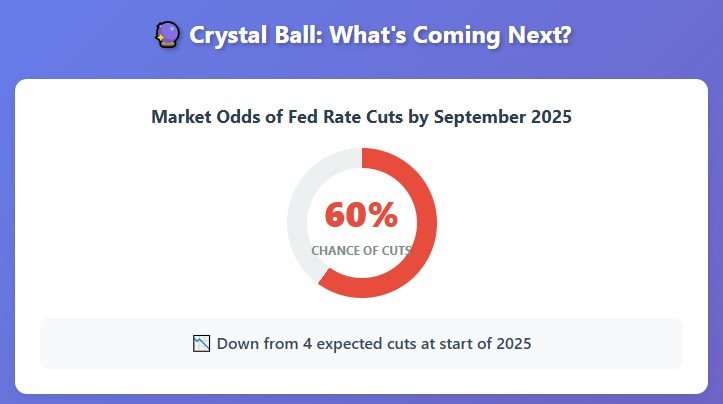

Fed officials are split on future rate cuts. Market odds show only a 60% chance of cuts by September 2025 – down from the four cuts everyone expected at the start of the year.

Fed Chair Powell basically said they’re stuck waiting to see how trade policies play out. Translation: your financial planning needs to account for continued uncertainty.

The Mortgage Market Reality Check

Fannie Mae predicts mortgage rates will end 2025 around 6.5% and 2026 around 6.1%. That’s still well above the 5% level that would unlock serious refinancing activity.

If you’re waiting for rates to crash back to pandemic lows, you’re probably going to wait a long time. The new normal likely means mortgage rates in the 5-7% range – higher than the 2010s but not catastrophic by historical standards.

Savings Rates Won’t Stay Sky-High Forever

As the Fed eventually cuts rates, high-yield savings will probably drop to around 3.8% by the end of 2025. Still good by recent standards, but not the bonanza we’re seeing now.

The smart move? Lock in good rates while you can and build systems that work even when rates change.

Your Action Plan for Right Now

Here’s what you should do with this information:

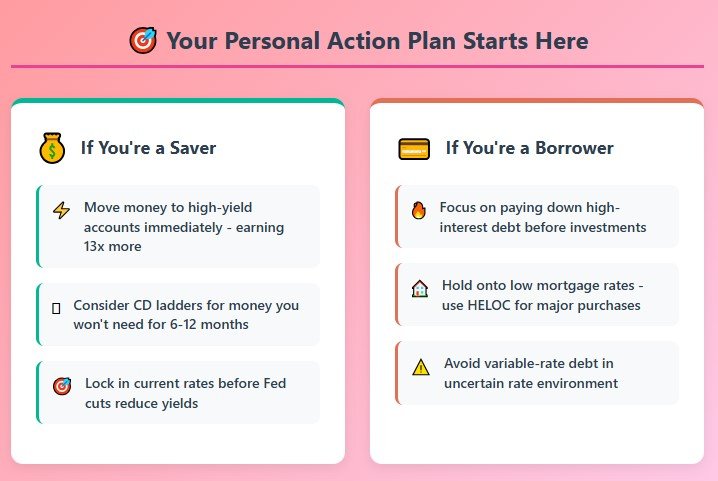

If you’re a saver: Move your money to high-yield accounts immediately. Consider CD ladders for money you won’t need for 6-12 months. This is the easiest financial upgrade you can make.

If you’re a borrower: Focus on paying down high-interest debt before worrying about investments. If you have a low mortgage rate, hold onto it for dear life – use home equity lines for major purchases instead of refinancing.

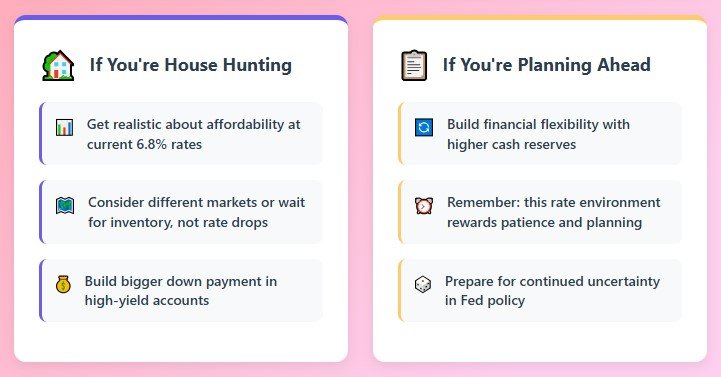

If you’re house hunting: Get realistic about what you can afford at current rates. Consider looking at different markets or waiting for more inventory, but don’t wait for rates to crash.

If you’re planning: Build financial flexibility. Keep more cash in high-yield accounts, avoid taking on variable-rate debt, and remember that this rate environment rewards patience and planning.

The Bottom Line

We’re living through a unique moment where traditional financial rules don’t quite apply. The Fed’s policies have created clear winners and losers, but the biggest advantage goes to people who understand the new game and play it accordingly.

Your bank account doesn’t care about economic theory – it cares about the decisions you make with the information you have. Right now, that information says: move your cash to higher-yield accounts, pay off expensive debt, and be strategic about major financial decisions.

The financial landscape has shifted permanently. Success means adapting to these new realities instead of waiting for things to go back to “normal.” Because this might just be the new normal – and that’s not necessarily bad news if you play your cards right.

What’s your next move? Check your savings account rate, calculate what you’re missing out on, and make the switch. Your future self will thank you for taking action today instead of just reading about it.