You’re 25, just started your first “real” job, and you’re feeling pretty good about contributing to your 401(k). You’ve heard all the advice about starting early, and you’re doing it! Fast forward 40 years, and you discover that nearly $590,000 of your retirement savings has vanished—not from market crashes or bad investments, but from fees you never even knew you were paying.

Sound like a nightmare? Unfortunately, it’s reality for millions of Americans.

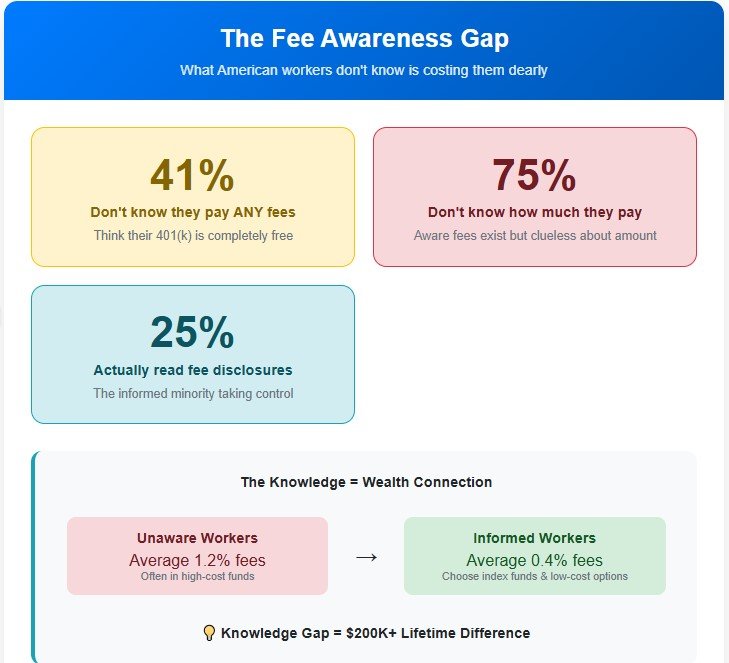

Here’s the kicker: 41% of workers have no idea they’re paying retirement fees at all. They think their 401(k) is just… free. Meanwhile, these invisible costs are quietly devouring up to one-third of their investment returns over a lifetime.

I know what you’re thinking: “Come on, how bad can a small fee really be?” Let me show you exactly how bad.

The Shocking Math That Will Keep You Up Tonight

Let’s say you’re that 25-year-old I mentioned. You start with $25,000 in retirement savings and faithfully contribute $10,000 every year. Sounds responsible, right?

Now here’s where it gets ugly. If your investments earn 7% annually but you’re paying just 1% more in fees than you should be, here’s what happens:

- Without the extra fees, you retire with about $2.3 million

- With that “tiny” 1% fee, you retire with $1.7 million

- The difference: $590,000 stolen by fees

That’s not a typo. Six hundred thousand dollars—gone. That’s more than most people’s entire house, lost to fees that many people don’t even know exist.

But wait, it gets worse.

The Awareness Crisis That’s Costing You Big

Ready for some statistics that’ll make your blood boil? Recent studies have found that:

- 75% of 401(k) participants don’t know how much they pay in fees

- Over one-third believe they aren’t paying any fees at all

- Only 1 in 4 workers read and understood their fee disclosures

It’s like going to a restaurant, eating a meal, and then being shocked when they bring you a bill. Except in this case, the bill is being automatically deducted from your future, and the restaurant isn’t telling you what you’re paying for.

Carson McLean, a certified financial planner, puts it bluntly: “The industry-average fee on a $3 million account works out to $26,400 per year. Over a decade, that’s a quarter of a million dollars—and it’s often a complete surprise to retirees.”

The Sneaky Ways Fees Are Hiding in Your Retirement Account

So where exactly are these wealth-destroying fees hiding? They’re more creative than you might think.

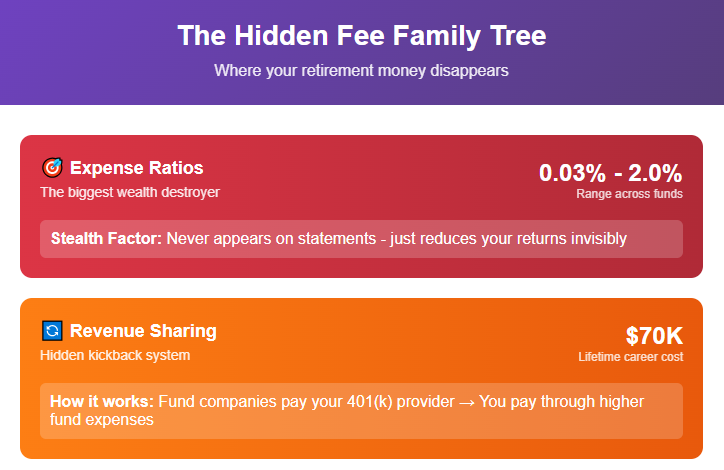

The “Invisible” Expense Ratio

This is the big one. Every mutual fund in your 401(k) charges what’s called an expense ratio—basically, the annual cost of running the fund. But here’s the sneaky part: this fee is automatically deducted from your returns.

You never see it on a statement. You never write a check. Your fund just quietly earns 6.3% instead of 7%, and you assume that’s just how the market performed.

These expense ratios can range from 0.03% (basically nothing) to over 2% (basically highway robbery). A seemingly tiny difference of 0.60% can cost you $8,630 over 30 years on just a $10,000 investment.

The Revenue-Sharing Shell Game

This one’s particularly infuriating. Your 401(k) provider needs to get paid for maintaining your account, right? Fair enough. But instead of charging you a transparent fee, they often get paid through hidden kickbacks from the mutual funds in your plan.

It works like this: The mutual fund companies pay your 401(k) provider to be included in your plan’s investment options. Guess who ultimately pays for those kickbacks? You do, through higher fund expenses.

Six of the top ten highest-priced 401(k) providers also ranked in the top ten for percentage of hidden fees. Coincidence? I think not.

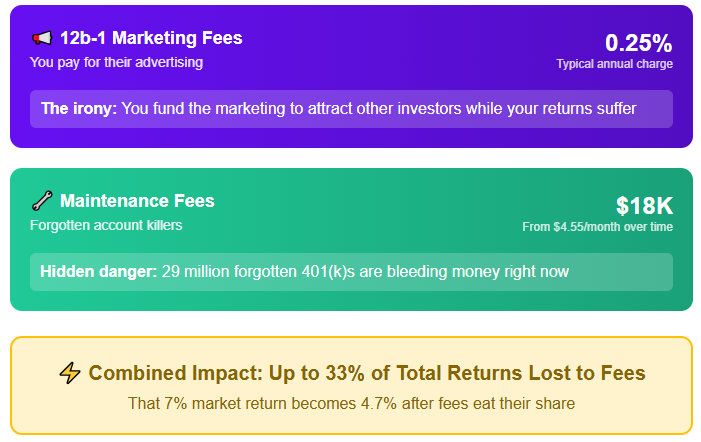

The “Forgotten Account” Fee Trap

Here’s a scenario that’s happening to millions of Americans right now. You change jobs and leave your old 401(k) behind. No big deal, right? It’s still growing, still invested.

Wrong. 29 million forgotten 401(k) accounts are hemorrhaging money through maintenance fees. That innocent-looking $4.55 monthly fee can grow to $18,000 in hidden costs over time. And here’s the frustrating part: you might not even know it’s happening.

The Small vs. Big Company Fee Disaster

Think all 401(k) plans are created equal? Think again. Your company size dramatically affects how much you’ll pay in fees, and it’s not even close to fair.

- Small company plans (under $1 million): Average 1.42% in total costs

- Large company plans (over $100 million): Average just 0.38% in total costs

That means if you work for a small company, you could be paying nearly four times more for the exact same type of account. It’s like being charged $100 for a burger just because you’re eating at a smaller restaurant.

Real People, Real Losses: The Stories That Matter

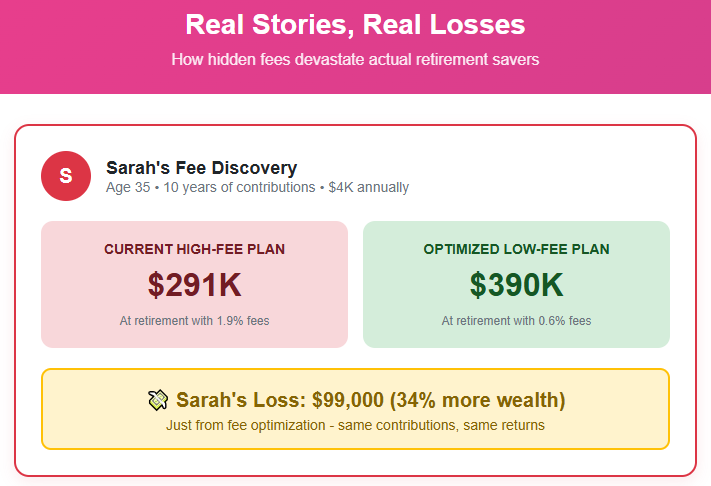

Let me tell you about Sarah (not her real name, but her situation is very real). She’s 35, makes decent money, and has been diligently contributing to her 401(k) for 10 years. She recently discovered her plan was charging her 1.9% in total fees.

I ran the numbers for her. If she keeps contributing $4,000 annually until retirement:

- With her current 1.9% fees, she’ll have about $291,000 at retirement

- If she could get those fees down to 0.6%, she’d have $390,000 at retirement

That’s a $99,000 difference—34% more money—just from understanding and optimizing her fees.

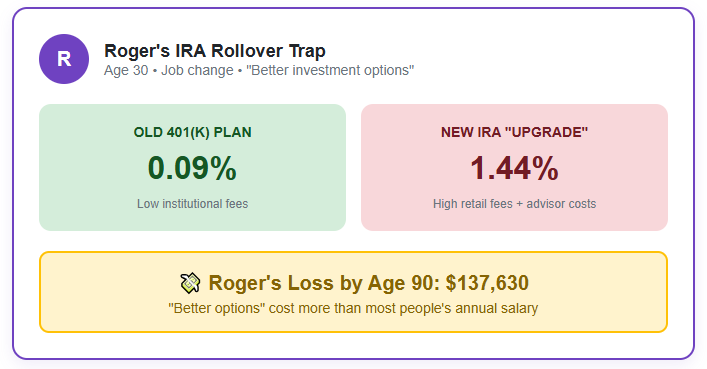

Or take Roger, a 30-year-old who recently left his job. His financial advisor convinced him to roll his 401(k) into an IRA with “better investment options.” What the advisor didn’t mention was that Roger went from paying 0.09% in his old 401(k) to 1.44% in his new IRA.

By age 90, that difference will cost Roger $137,630. His “better” investment options just cost him more than most people’s annual salary.

The IRA Rollover Trap That’s Costing Billions

Speaking of rollovers, here’s something your financial advisor might not tell you: Rolling your 401(k) into an IRA often means paying significantly higher fees.

Recent research found that workers moving money from 401(k)s to IRAs could collectively pay $45.5 billion in extra fees over 25 years. Here’s why:

- 401(k) plans often have access to institutional share classes with lower fees

- IRAs typically only offer retail share classes that cost 37% more for stock funds and 56% more for bond funds

The financial services industry loves IRA rollovers because they’re often more profitable. But that profit comes straight out of your retirement savings.

The Fee Reduction Success Stories

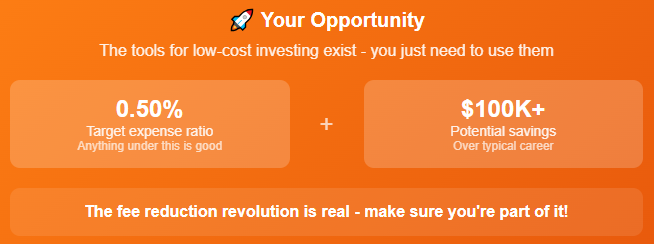

Okay, enough doom and gloom. Let’s talk solutions. The good news is that fees have been dropping dramatically over the past two decades, and smart savers are keeping more of their money.

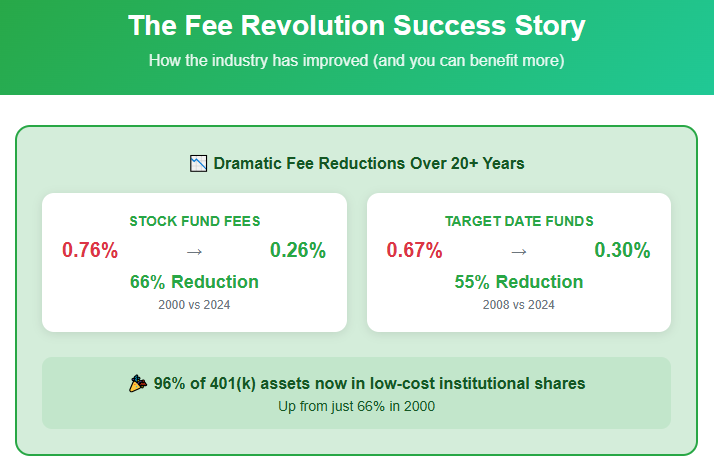

401(k) equity mutual fund fees have dropped 66% since 2000, from 0.76% to just 0.26%. Target-date funds—those “set it and forget it” options—have seen their fees fall 55% since 2008.

Even better, 96% of 401(k) mutual fund assets are now in no-load institutional share classes, up from just 66% in 2000. Translation: The industry is slowly getting better, and you can benefit if you know what to look for.

Your Action Plan: How to Fight Back Against Hidden Fees

Ready to stop being a victim? Here’s exactly what you need to do:

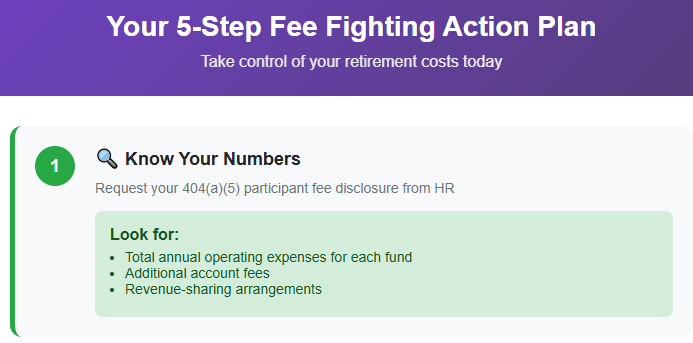

Step 1: Know Your Numbers

Call your HR department and request your 404(a)(5) participant fee disclosure. This document, required by law, shows you exactly what you’re paying. Don’t let them tell you they don’t have it—they do.

Look for:

- Total annual operating expenses for each fund

- Any additional fees charged to your account

- Revenue-sharing arrangements (these should be disclosed)

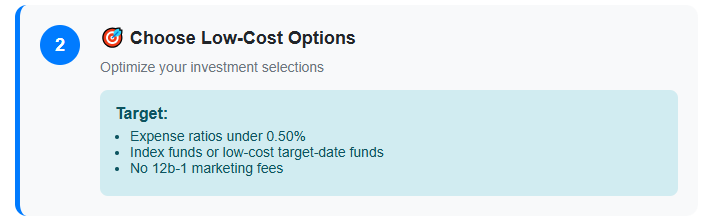

Step 2: Choose Low-Cost Options

Once you know what you’re paying, here’s what to look for:

- Expense ratios under 0.50% (anything over 1% is getting expensive)

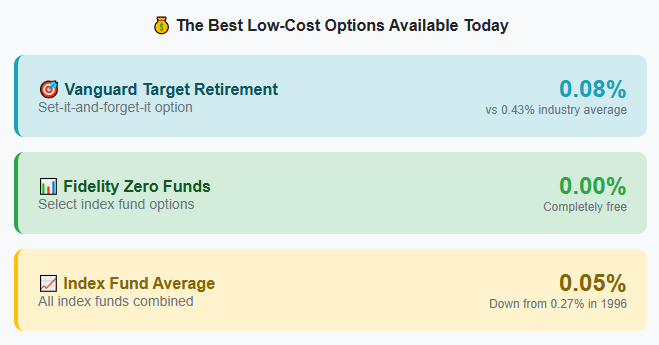

- Index funds or low-cost target-date funds (Vanguard’s target-date funds charge just 0.08% vs. the industry average of 0.43%)

- No 12b-1 marketing fees (these are just paying for someone else’s marketing)

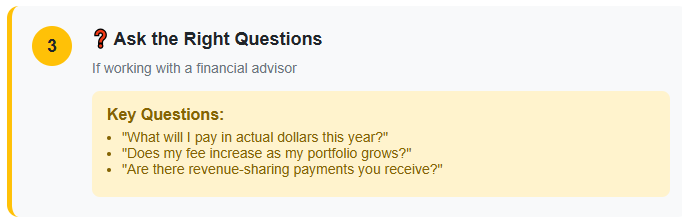

Step 3: Ask the Right Questions

If you’re working with a financial advisor, ask them:

- “What will I pay in actual dollars this year?” (not percentages—dollars)

- “Does my fee increase as my portfolio grows?”

- “Are there any revenue-sharing payments you receive from my investments?”

Step 4: Consider Fee-Only Advisors

If you need professional help, consider fee-only advisors who charge transparent flat fees instead of percentage-based fees. The average annual retainer is about $4,484, which could be much cheaper than percentage-based fees as your account grows.

Step 5: Don’t Rush Into IRA Rollovers

Before rolling your 401(k) into an IRA, compare the fees carefully. In many cases, especially with large employers, keeping your money in the 401(k) will save you thousands in fees over time.

The Bottom Line: Your Financial Future Is Too Important to Leave to Chance

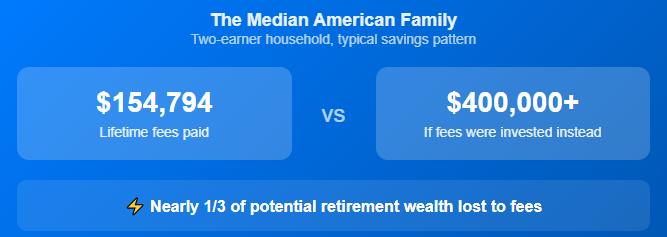

Here’s the reality: The median American family will pay $154,794 in lifetime retirement fees. That same money, if invested instead of paid in fees, could have grown to over $400,000.

You’re choosing between a comfortable retirement and a wealthy one. The difference? Understanding and optimizing the fees you pay.

The financial services industry isn’t going to volunteer to charge you less. They’re not going to call you up and say, “Hey, we’ve been overcharging you for decades.” It’s up to you to take control.

But here’s what gives me hope: Every percentage point you reduce in fees is a percentage point that stays in your pocket, compounding for your future instead of funding someone else’s yacht.

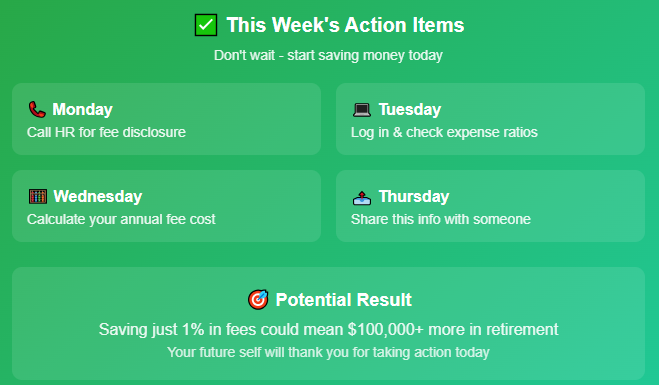

Take Action Today

Don’t let this article be just another thing you read and forget. Your future self—the one sitting in retirement—is counting on the decisions you make today.

Here’s what I want you to do right now:

- Set a calendar reminder to request your fee disclosure from HR this week

- Log into your 401(k) account and write down the expense ratio of each fund you’re invested in

- Calculate your annual fee cost by multiplying your account balance by your total expense ratio

- Share this article with someone you care about who might be getting crushed by hidden fees

Remember: The best time to start optimizing your retirement fees was 20 years ago. The second-best time is today. Your future millionaire self will thank you.