You’ve just checked into your hotel after a long flight. You’re exhausted, your phone’s buzzing with work emails, and you need to quickly check your bank balance before that automatic payment goes through tomorrow.

You connect to the hotel WiFi and log into your banking app. Easy, right? Wrong. Dead wrong.

You’ve just made the #1 mistake that airport security experts and cybersecurity professionals are desperately trying to warn travelers about. And if you’re like 90% of people, you probably do this without thinking twice.

Here’s what they know that you don’t: Banking on hotel WiFi is like handing your wallet to a stranger and asking them to “please don’t steal anything.”

The Numbers Don’t Lie (And They’re Terrifying)

🚨 Hotel WiFi Security Crisis: The Alarming Numbers

Let me hit you with some facts that’ll make your stomach drop:

- 90% of hotel networks were hit by cyberattacks in summer 2024 alone

- Banking credentials are the #1 target for cybercriminals on public networks

- Hotel WiFi accounts for 20% of all personal data breaches on public networks

- The average cost of a hospitality data breach? $3.86 million (and climbing)

But here’s the kicker: Back in 2019, security researchers tested WiFi at 45 hotels across five countries. Want to guess how many passed basic security tests?

Zero. Not a single one.

Why the FBI Is Practically Screaming at You

The FBI doesn’t usually get involved in travel tips. But they’ve issued specific warnings telling you to “avoid accessing sensitive websites, such as banking sites,” on hotel networks.

The Transportation Security Administration calls hotel WiFi a “top security threat.”

CISA (that’s the Cybersecurity and Infrastructure Security Agency) warns that “malicious actors could use sniffing tools to obtain sensitive information such as passwords or credit card numbers” on these networks.

When three major government agencies are all saying the same thing, you should probably listen.

The DarkHotel Story That’ll Give You Nightmares

Ready for something that sounds like a spy movie but is 100% real?

Meet DarkHotel—a group of sophisticated cybercriminals who spent nearly a decade targeting business executives through luxury hotel networks. From 2004 to 2014, they operated completely undetected.

Here’s how they did it:

Step 1: They’d hack into hotel systems before high-value targets even arrived.

Step 2: Using guest check-in info, they’d identify executives by name and room number

Step 3: When these executives logged into the hotel WiFi, they’d get a fake “software update.”

Step 4: That “update” was sophisticated spyware designed to steal banking credentials

The result? Thousands of victims globally, with criminals capturing every keystroke during banking sessions, installing malware that targeted 40+ financial services, and even planting rootkits that survived system reboots.

And most victims never even knew they’d been hacked.

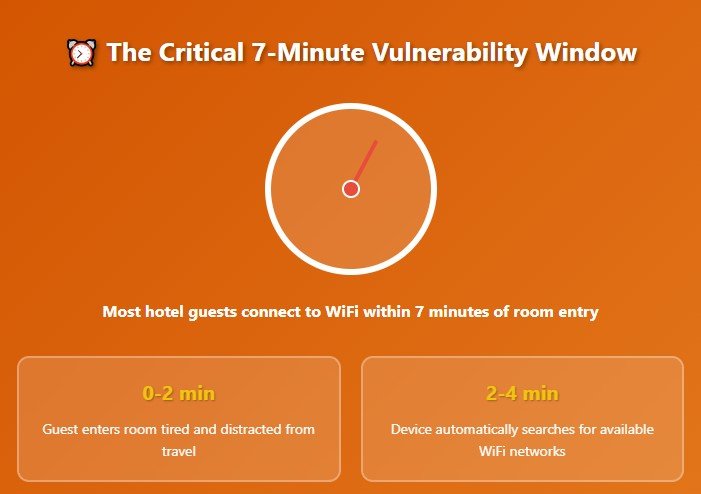

The Seven-Minute Window of Vulnerability

Here’s something fascinating (and terrifying): Research shows that most hotel guests connect to WiFi within the first seven minutes of entering their room.

Think about it. You’re tired, distracted, and just want to get online fast. You see “Hotel_WiFi” pop up and click connect without a second thought.

Criminals know this. They’ve weaponized your predictable behavior.

Tools like Wifiphisher can automatically detect when your device is searching for hotel networks and present convincing fake login portals specifically designed to capture your banking info.

The success rate? Over 80% of travelers will connect to any available WiFi network when they’re away from home.

What Happens When You Bank on Hotel WiFi

Let me break down the technical stuff in plain English:

The “Dirty Network” Problem

Hotels deal with hundreds of unknown devices every day. Your phone, that sketchy guest’s laptop, IoT devices in every room—they’re all sharing the same network.

A recent audit found 35 connected devices per hotel room on average. Smart TVs, thermostats, keyless entry systems—each one is a potential backdoor for hackers.

The Captive Portal Trap

You know that login page that pops up when you connect to the hotel WiFi? It looks secure, but it’s an open network where your data is unencrypted until you complete authentication.

During those few seconds of a handshake, your banking passwords can be intercepted by anyone monitoring the network.

The Fake Network Game

Criminals create networks with names like “Hotel_Guest” or “Free_Hotel_Internet.” Since most people don’t verify the real network name with hotel staff, these fake networks get tons of connections.

Once you’re connected to their network, they can see everything you do online.

Real-World Financial Damage (It’s Worse Than You Think)

💸 Real Financial Devastation from Hotel Network Breaches

Hotel industry’s share of global data breaches has doubled in 5 years

This isn’t theoretical. Here are real examples:

MGM Resorts: Lost over $100 million from a 2023 cyberattack that started with network vulnerabilities

Caesars Entertainment: Paid a $15 million ransom to prevent customer financial data from being released publicly

Marriott: Their 2018 breach affected 500 million guests, with hackers accessing the system for four years while harvesting payment card data

Motel One: 2023 compromise exposed 169 customer credit cards plus 6 terabytes of booking data

These aren’t small-time operations. These are sophisticated criminal enterprises making millions by targeting travelers who bank on public WiFi.

The AI Revolution Makes Everything Worse

Just when you thought hotel WiFi couldn’t get more dangerous, artificial intelligence entered the chat.

Reports show a 4,000% surge in phishing emails since ChatGPT launched. Criminals are using AI to create personalized banking phishing attacks based on stolen hotel reservation data.

Voice-based scams increased by 500% in 2024. You bank on hotel WiFi, your credentials get compromised, and the next day you get a call from someone who sounds exactly like your bank representative asking for “additional verification.”

That voice? AI-generated. That call? A scam designed to steal even more of your financial information.

Why Hotels Can’t (Or Won’t) Protect You

Here’s the uncomfortable truth: Only 37% of hospitality professionals feel prepared to handle cybersecurity attacks.

31% of hotels don’t even have comprehensive employee security training.

The problem gets worse with franchise hotels. Security standards vary dramatically between locations, even within the same brand. That Holiday Inn in downtown Chicago might have decent security, but the one by the airport? Maybe not so much.

Budget hotels face the biggest challenges. Limited security budgets and minimal technical expertise mean many properties are operating with outdated network infrastructure that’s basically a welcome mat for cybercriminals.

What Smart Travelers Do Instead

Okay, so banking on hotel WiFi is out. What are your alternatives?

Use Your Phone’s Data Plan

This is your safest bet. Mobile carrier networks are significantly more secure than public WiFi. Yes, you might pay some overage fees, but that’s nothing compared to recovering from financial fraud.

Your phone can also create a secure hotspot for your laptop if needed.

VPNs: Helpful But Not Foolproof

A VPN adds a layer of protection, but it’s not magic. Many hotel captive portals require you to disable your VPN to connect initially, creating a vulnerability window.

Plus, if the underlying network is already infected with advanced malware, even VPN connections can be compromised.

Wait for a Secure Connection

Banking transactions that aren’t urgent can wait until you’re home or in your office. The convenience of immediate access is rarely worth the risk.

Verify Network Names

Always confirm the official WiFi network name with hotel staff. Never connect to networks with generic names like “Free_WiFi” without verification.

The Questions You’re Probably Asking

“But I use my banking app, not a website. Isn’t that safer?” Nope. Apps still send data over the same compromised network. If criminals can intercept your login credentials, the app vs. website distinction doesn’t matter.

“What if I only check my balance quickly?” There’s no such thing as “quick and safe” on hotel WiFi. The moment you enter your credentials, you’re vulnerable.

“I’ve been doing this for years and nothing’s happened.” That you know of. Many financial fraud victims don’t realize they’ve been compromised until weeks or months later when unauthorized charges appear.

The Hotel Industry’s Dirty Little Secret

Here’s what hotels don’t want you to know: 82% of North American hotels experienced cyberattacks during summer 2024. The hospitality industry now accounts for 4% of global data breaches—double the rate from 2019.

Despite this, investment in cybersecurity is still inadequate. While cybersecurity spending in travel is projected to reach $4.3 billion by 2027, most of that money goes to large chains. Budget properties—where many business travelers stay—continue operating with minimal protection.

Your Action Plan (What to Do Right Now)

🎯 Your Hotel WiFi Banking Security Action Plan

Following this action plan protects you from 95% of hotel WiFi banking threats with minimal effort

Here’s what every smart traveler needs to do:

- Delete saved hotel WiFi networks from your devices so you don’t auto-connect

- Set up mobile banking alerts for any account activity so you’ll know immediately if something’s wrong

- Use your cellular data for all financial transactions while traveling

- Wait until you’re home for non-urgent banking needs

- Verify network names with hotel staff before connecting to anything

The Bottom Line

Look, I get it. You’re tired, you need to check your account, and the hotel WiFi seems convenient. But convenience isn’t worth losing your financial security.

Every cybersecurity expert, every government agency, and every piece of research points to the same conclusion: Banking on hotel WiFi is dangerous. Period.

The criminals are getting smarter, the attacks are getting more sophisticated, and the financial damage is getting worse. Your bank account is worth more than the convenience of checking it from your hotel room.

So here’s my challenge to you: The next time you’re in a hotel room and feel the urge to check your banking app on the hotel WiFi, remember this article. Remember DarkHotel. Remember the FBI warnings. Remember the $100 million in damages.

Then use your phone’s data plan instead. Your future self will thank you.