You’re scrolling through Zillow on a beautiful Saturday morning in May. The sun is shining, the flowers are blooming, and that dream house just hit the market. Your heart races. This is it – the perfect time to buy!

Stop right there.

Your financial advisor would probably tackle you before letting you make that offer. Why? Because you’re about to walk into the most expensive trap in real estate.

Here’s what the pros don’t want you to find out the hard way: buying a home in May, June, or July could cost you an extra $33,600 to $62,200 compared to strategic winter timing. We’re not talking about a few hundred dollars here and there – this is real money that could fund your kid’s college or pay off debt.

Let me break down exactly why spring house hunting is financial self-sabotage, and show you when smart buyers make their moves.

The Three Months That Will Drain Your Bank Account

💸 Peak Season Cost Analysis: May-July Financial Impact

May: The Wallet Assassin

May isn’t just expensive – it’s the single most expensive month to buy a house. We’re talking about a 13.1% premium above normal market prices.

Think about that for a second. On a $400,000 house, you’re immediately paying an extra $52,400 just because you chose the wrong month. That’s a luxury car sitting in your driveway, except you don’t get the car.

June: Peak Insanity

June is when the housing market turns into Black Friday, except instead of fighting over TVs, you’re battling 47 other families for the same three-bedroom colonial.

Over 18,000 homes sell every single day in June nationwide. The competition is absolutely brutal. Your dream home? Seven other buyers want it too, and they’re all making offers above the asking price.

Your negotiating power? Zero. Zilch. Nada.

July: Still Terrible (Surprise!)

July keeps the party going with peak pricing and maximum chaos. Sure, you might start seeing a few more days on market toward the end of the month, but you’re still paying premium prices for the privilege of shopping during the circus.

Here’s the kicker: These three months account for 40% of all home sales despite being only 25% of the year. It’s like trying to buy concert tickets the day they go on sale – artificially created scarcity that drives prices through the roof.

The Winter Secret That Could Save You a Small Fortune

Want to know when smart money buys houses? December through February.

I know, I know. You’re thinking, “But it’s cold! And dark! And who wants to move in the snow?”

Here’s what you’re missing: That “inconvenience” could save you enough money to take a very nice vacation somewhere warm every year for the next decade.

The Numbers Don’t Lie

Home prices drop 16% from summer peaks during the winter months. On that same $400,000 house, you’re looking at $16,000 to $40,000 in immediate savings.

But wait, there’s more! (Sorry, couldn’t resist.)

Homes stay on the market 49 days in winter versus 31 days in peak season. That’s 60% more time for you to:

- Get a thorough inspection

- Think about your decision

- Negotiate like a human being instead of a panicked bidding war participant

Mortgage rates historically drop 20 basis points in January and February. Sounds small? Over the life of your loan, that’s $16,200 to $18,000 in savings.

Moving costs plummet 10-30% during winter. Only 10% of people move between December and February, which means moving companies are practically begging for your business.

Add it all up, and you’re looking at $33,600 to $62,200 in total savings just for being smart about timing.

What the Experts Are Saying (It Might Surprise You)

Remember all that advice about buying when it’s convenient? When the weather’s nice? When are the kids out of school?

Financial advisors are quietly telling their clients to ignore all of that.

Dave Ramsey’s team puts it bluntly: “The worst time to buy a house is typically the late spring and early summer (May through July). That’s because tons of people are in the market to buy a home—which means you’ll face more competition.”

Joel Berner, Senior Economist at Realtor.com, acknowledges what the industry doesn’t like to advertise: spring creates “systematic disadvantages for buyers.”

Even housing economists who usually preach “time in the market beats timing the market” admit that seasonal patterns create real, measurable financial impacts.

But here’s the most important thing every expert agrees on: Your financial readiness matters more than timing. Don’t compromise your emergency fund or mortgage qualification just to hit the “perfect” buying season.

Your Location Changes Everything

Not all seasonal savings are created equal. Where you live makes a huge difference in how much money smart timing can save you.

The Midwest and Northeast: Jackpot Territory

If you live in places like Cleveland, Chicago, Detroit, or Minneapolis, you hit the seasonal savings lottery. Some areas show over 35% price swings between peak and off-season.

Cleveland leads the pack with a -35.3% seasonal variation. Think about that – the same house could cost $135,000 less in winter than in summer.

The South: Hurricane Season Complications

Southern markets have their weird patterns. Hurricane season (June through November) creates uncertainty that can work in your favor during traditional “peak” months.

Plus, “snowbird” migration patterns mean some Southern markets are busiest when the rest of the country is hibernating.

The West: Steady As She Goes

Western states maintain more stable year-round pricing, making timing less critical. But don’t ignore the opportunity entirely – you can still save money, just not the dramatic amounts you’d see in Chicago.

Pro tip: If you live in a mountain or coastal resort area, you might be dealing with dual seasons tied to recreation patterns. Know your local market’s unique rhythm.

The Hidden Costs Nobody Talks About

Think the purchase price is the only seasonal factor? Think again. The hidden costs add up fast.

Moving Mayhem

Summer moves cost 10-30% more than winter moves. We’re talking an extra $800 to $2,400 just to get your stuff from Point A to Point B.

Why? Because 62% of all moves happen between May and September. Supply and demand, baby.

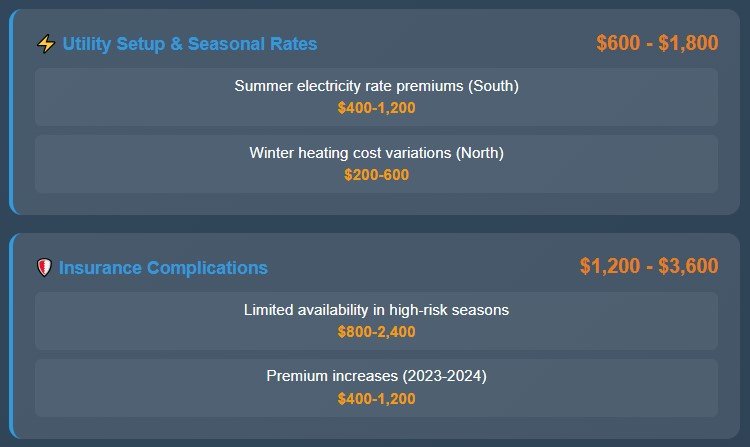

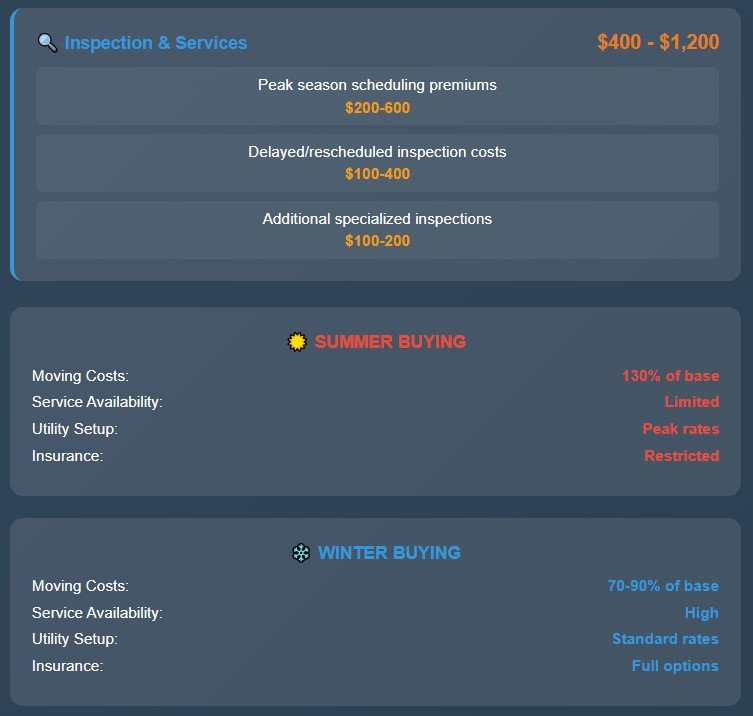

Utility Setup Sticker Shock

Southern states can hit you with summer electricity rates that are 3X higher than regular rates during peak demand. Northern heating costs vary wildly depending on when you move in and what type of energy your new home uses.

Budget an extra $600 to $1,800 for first-year utility variations based on move-in timing.

Insurance Nightmares

Homeowners insurance premiums jumped 12% in 2023 and another 6.9% in early 2024. Some high-risk areas now have zero private insurance options during peak weather seasons.

Inspection Complications

Winter inspections might miss roofing issues due to snow, but they’re fantastic for catching heating system problems and energy efficiency issues.

Summer inspections face scheduling delays and may get complicated by hurricane season in affected areas.

When Life Forces Your Hand: Spring Buying Survival Guide

🛡️ Peak Season Survival Guide: Minimize Damage When You Must Buy

OPTIMAL

OPTIMAL

RISING

BUSY

AVOID

AVOID

AVOID

COOLING

GOOD

STEADY

QUIET

OPTIMAL

Look, sometimes life doesn’t care about your perfect timing. Job relocation, family changes, lease expirations – stuff happens.

If you absolutely must buy during the expensive months, here’s how to minimize the damage:

Target the Shoulder Seasons

Late August through September is your friend. Peak competition starts dying down, but inventory is still decent. September 2024 showed $15,000 price drops from July peaks.

Get Pre-Approved in January

Even if you’re not buying until spring, get your financing locked down during the winter rate advantage period. Some mortgage products allow extended locks that can save you money even if rates rise.

Master the Art of Mid-Week, Mid-Month

Moving companies offer discounts for Tuesday and Wednesday moves, even during the busy season. The same goes for mid-month timing when demand is lower.

Hunt for Motivated Sellers

Look for telltale signs:

- Extended time on market

- Price reductions

- Specific seller circumstances (job relocation, divorce, estate sales)

These situations create negotiation opportunities even when the overall market is bonkers.

Budget for the Premium

Add 15-35% to your base budget for seasonal premiums across all transaction costs. This prevents financial strain and keeps you competitive when you need to move fast.

The Bottom Line: Smart Timing = Real Money

Here’s what it all comes down to: Strategic seasonal timing can save you tens of thousands of dollars without any additional risk or compromise to your home-buying goals.

The math is crystal clear. May, June, and July represent the perfect storm of maximum competition, inflated prices, and elevated costs across every aspect of your home purchase.

December through February is where smart money shops. September offers a solid Plan B if winter logistics don’t work for your situation.

But remember – and this is crucial – never compromise your financial readiness for timing advantages. The best time to buy a house is when you’re financially prepared, have a stable income, and can comfortably afford the monthly payments.

The sweet spot? Combine solid financial preparation with strategic seasonal awareness. Be ready to buy, then choose your timing wisely.

Your future self (and your bank account) will thank you for waiting a few months instead of jumping into the spring feeding frenzy. Sometimes the best financial decisions are the ones that feel a little uncomfortable in the moment but pay off big over time.

Ready to start your home-buying journey the smart way? Begin by getting pre-qualified during the winter rate advantage period, even if you’re not ready to buy immediately. That way, when the perfect opportunity comes along during optimal timing, you’re ready to move quickly and confidently.