You open your property tax bill and nearly choke on your coffee. $8,400 for the year? Your neighbor across the street has a similar house but only pays $4,200.

What’s their secret? They know something you don’t.

Here’s the crazy part – billions of dollars in property tax savings are sitting unclaimed right now. We’re talking about legitimate, government-approved programs that could slash your property tax bill by $1,000 to $8,000+ every single year.

Texas alone handed out $18 billion in property tax relief in 2023. That’s not a typo. Billion with a “B.”

Yet most homeowners have no clue these programs exist. Are you leaving money on the table?

The Hidden Truth About Property Tax Relief

Let’s be real for a second. Property taxes feel like that friend who keeps asking to borrow money – they just keep going up and up.

Over the past five years, property values have skyrocketed 60% nationwide. Your property taxes? They’ve been happily riding that wave right into your wallet.

But here’s what the tax assessor’s office isn’t advertising on billboards: Every state has programs designed to give you a break.

Some are so generous they’ll wipe out your entire property tax bill. Others offer thousands in annual savings. The catch? You have to know about them and apply.

It’s like having a coupon for half off your grocery bill, but the store forgot to mention it exists.

The Big Four: Programs That Pack the Biggest Punch

Many programs can be stacked together for maximum savings!

Homestead Exemptions: Your Foundation for Savings

Think of homestead exemptions as your property tax safety net. They protect the place you call home.

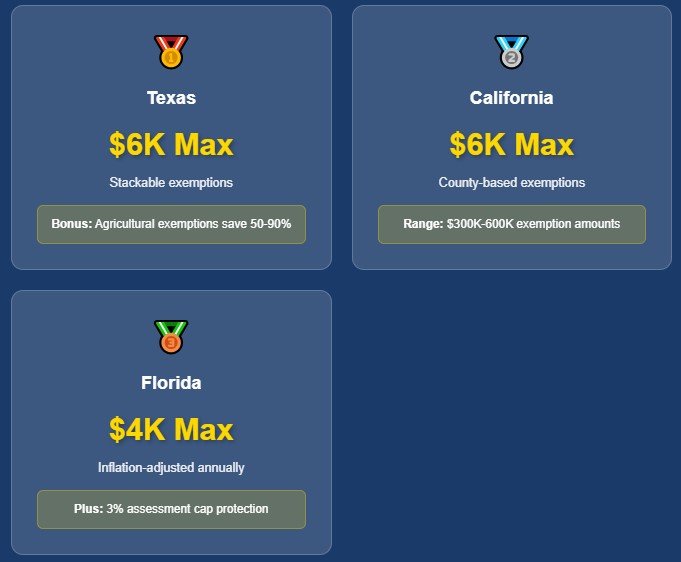

Texas homeowners are living the dream right now. The state recently bumped its mandatory school district exemption to $100,000. Translation? The average Texas homeowner saves $2,000 to $4,000 every year.

Not bad for filling out some paperwork, right?

Florida keeps it interesting by tying their exemption to inflation. In 2025, that means $50,722 comes right off your assessed value. Depending on your local tax rate, that’s $800 to $3,000+ back in your pocket annually.

Even California, not exactly known for being tax-friendly, offers homestead exemptions ranging from $300,000 to $600,000 based on your county. That translates to $3,000 to $6,000+ in annual savings.

Veterans Exemptions: Thank You for Your Service (Literally)

If you’re a veteran, especially one with a service-connected disability, prepare to be amazed.

Twenty states offer complete property tax exemptions for 100% disabled veterans. We’re talking zero dollars. Zilch. Nada.

Let that sink in. If you qualify, you could save $3,000 to $8,000+ every year for the rest of your life.

States like Alabama, Florida, Illinois, Michigan, Nebraska, Oklahoma, South Carolina, Texas, and Virginia all roll out the red carpet with full exemptions.

Even if you don’t qualify for the full exemption, many states offer substantial breaks. Georgia provides exemptions up to $121,812. California goes up to $254,656 for qualifying veterans.

Senior Citizen Exemptions: Aging Has Its Privileges

Hit the magic age (usually 62-65), and suddenly the government gets a lot friendlier about your property taxes.

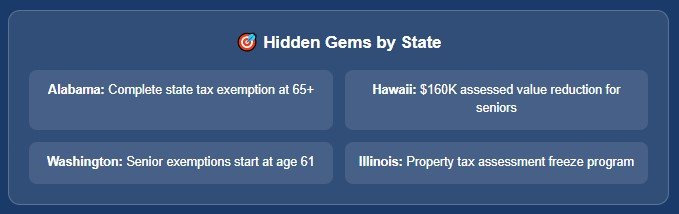

New York’s Enhanced STAR program hands out up to $50,000 in exemptions for qualifying seniors. Colorado cuts your assessed value in half on the first $200,000.

Here’s a cool one: Illinois offers a “Senior Freeze” program that locks your assessed value at your base year level. As property values go up around you, your taxes stay put. It’s like having a time machine for your tax bill.

Alabama takes the crown, though. Seniors 65+ get a complete state property tax exemption. Yes, complete.

Energy Efficiency Exemptions: Go Green, Save Green

Thirty-six states have figured out how to make going green pay off immediately.

Install solar panels, and they won’t jack up your property taxes. Some programs save homeowners $200 to $1,000+ annually while helping the planet.

California, Florida, Texas, and Colorado lead the pack with comprehensive clean energy exemption programs. It’s a win-win-win situation.

State Spotlight: Where the Money Lives

Texas: The Property Tax Relief Champion

Texas doesn’t mess around when it comes to property tax relief. They’re like the overachiever in the group project who makes everyone else look bad.

Here’s how Texas homeowners can stack their savings:

- General homestead exemption: $100,000 off assessed value

- Senior/disability bonus: Additional $10,000

- Local option exemptions: Up to 20% of property value

Smart homeowners are combining these for $3,000 to $6,000+ in annual savings.

But wait, there’s more. Texas’s agricultural exemptions can slash suburban property taxes by 50-90% if you qualify. We’re talking about grazing a single cow on your acreage and watching your tax bill disappear.

Florida: The Sunshine State’s Sweet Deal

Florida homeowners get a double dose of protection. The $50,722 homestead exemption is just the appetizer.

The main course? The Save Our Homes assessment cap limits annual increases to 3%. Even if your property value shoots up 15% in a year, your taxable value only budges 3%.

Combine everything, and eligible Florida homeowners save $2,000 to $4,000+ annually. Not bad for a state with no income tax, either.

New York: Surprising Generosity in the Empire State

New York gets a bad rap for taxes, but it’s pretty generous with property tax relief.

The STAR program saves basic participants an average of $323 annually. Enhanced STAR participants (seniors with income limits) average $345 in savings.

Stack that with local senior and disability exemptions, and total savings can hit $2,000 to $5,000+.

The Participation Problem: Why Are People Missing Out?

Here’s the frustrating part. These programs exist, they’re legitimate, and they can save you thousands. So why isn’t everyone using them?

New York City’s STAR program shows only 57-64% participation among eligible households. That’s $69 million in unclaimed savings over just two years in one city.

Cook County found that 24% of eligible reverse mortgage borrowers don’t participate in any property tax relief programs. Some are missing multiple exemptions simultaneously.

The pattern is clear: Urban areas consistently underperform. Manhattan shows less than 50% participation in available programs.

The Real Barriers Keeping You From Savings

University of Michigan research identified six main barriers:

- Limited awareness (22.8% never even get applications)

- Application complexity (it’s not as hard as you think)

- Insufficient information (nobody’s advertising this stuff)

- Mobility restrictions (hard to get to government offices)

- Administrative accountability issues (government red tape)

- Prior negative experiences (one bad experience = never trying again)

Busting the Biggest Myths

78% of homeowners qualify for at least one exemption program

“I Make Too Much Money”

This is the #1 reason people don’t apply, and it’s usually wrong.

New York’s Enhanced STAR allows incomes up to $107,300. Many programs have no income limits at all.

Unless you’re Jeff Bezos reading this, you probably qualify for something.

“My House Is Too Expensive”

Another myth. Most programs apply regardless of property value.

That million-dollar home? Still eligible for homestead exemptions in most states.

“It’s Too Complicated”

The biggest myth of all.

Most basic homestead exemptions require 2-3 forms and take 15-30 minutes to complete. You’ve spent more time picking a Netflix show.

Hidden Gems: Programs You’ve Never Heard Of

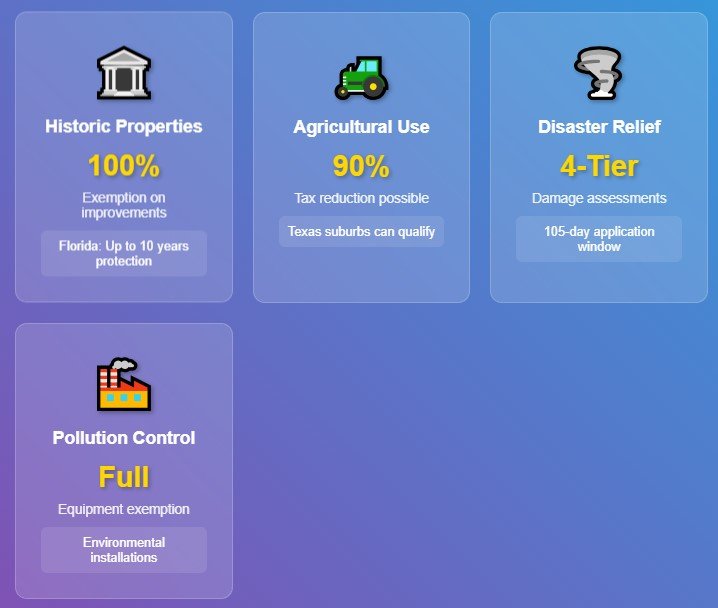

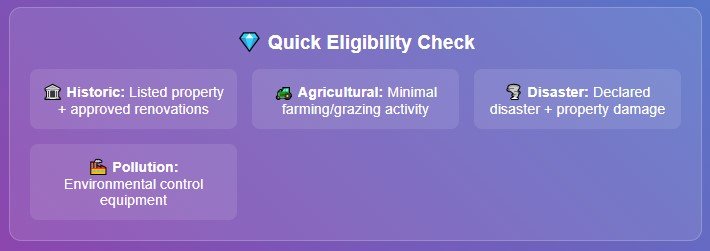

Historic Property Exemptions

Own a historic home? You might qualify for up to 100% relief on increased assessed value from approved renovations.

Florida’s program lasts up to 10 years. Austin, Texas, offers complete abatement on historic district improvements.

Federal historic preservation tax credits of 20% can be combined with state programs for maximum benefit.

Agricultural Exemptions (Yes, in the Suburbs)

This one’s sneaky. Texas’s 1-D-1 program can reduce property taxes 50-90% with minimal agricultural activity.

Some sources mention grazing a single cow as sufficient. Warning: These programs carry severe rollback penalties (5 years of back taxes plus interest) if violated.

Disaster Recovery Exemptions

Property damaged in a declared disaster? Temporary relief programs exist.

Texas offers four-tier damage assessments with corresponding exemption percentages. California allows base year value transfers between counties for disaster victims.

Applications must be filed within 105 days of disaster declarations.

Real People, Real Savings

The Texas Success Stories

When Texas implemented its recent relief package, real homeowners saw real results:

- Average homeowners: $1,750 annual savings

- Seniors and disabled individuals: $2,300+ annual savings

- Business owners: $2,500 average relief

The Cook County Comeback

Cook County demonstrates the power of retroactive relief. Homeowners can reclaim missed exemptions from 2020-2024 through “Certificate of Error” applications.

The county’s $950 average annual savings from basic homeowner exemptions compound to nearly $5,000 over five years for previously unprotected homeowners.

Philadelphia’s Smart System

Philadelphia’s $100,000 homestead exemption provides approximately $1,399 in annual savings with automatic renewal once approved.

No yearly paperwork. No renewal hassles. Just ongoing savings.

Your Action Plan: How to Claim Your Savings

Step 1: Know Your Deadlines

Timing is everything:

- California: February 15 for full exemptions (80% available until December 10)

- Texas: May 1 deadline

- Georgia: April 1 (with 45-day appeal window)

Miss the deadline? You might have to wait until next year.

Step 2: Gather Your Documents

Standard requirements:

- Property deed

- Valid ID matching property address

- Social Security number

Veterans need: DD-214 discharge papers and VA disability rating

Seniors need: Age verification

Disabled applicants need: Medical documentation or disability determination letters

Step 3: Find Your Application Location

Most states use county assessor offices. Some variations:

- California: Form BOE-266

- Texas: Form 50-114

- Cook County: Chief County Assessment Office

Online applications are increasingly available, though paper filing remains standard.

Step 4: Think Strategically

- Check for retroactive benefits (some counties allow multi-year claims)

- Understand automatic renewal policies (most continue indefinitely once approved)

- Explore exemption stacking opportunities where multiple programs combine

Don’t Let These Mistakes Cost You

The Assumption Trap

Don’t assume you don’t qualify. The worst they can say is no, and applications are usually free.

The Complexity Fear

Most applications are simpler than you think. If you can file your taxes, you can handle a property tax exemption application.

The “I’ll Do It Later” Syndrome

Deadlines are real. Miss them, and you’re stuck paying full freight for another year.

The One-Size-Fits-All Mistake

Every state is different. What works in Texas won’t necessarily work in New York. Research your specific state’s programs.

Looking Ahead: The Future Is Bright

Property tax relief programs are expanding, not shrinking.

Short-term trends (2025-2027) point toward continued expansion. Mountain West states are leading reform efforts as they grapple with affordability pressures.

Technology integration will improve both assessment accuracy and application processes. AI-enabled systems by 2025-2030 may streamline exemption applications through automated eligibility verification.

The political momentum remains strong across party lines. Record property value increases, aging demographics, and state budget surpluses are creating perfect conditions for more relief programs.

Your Next Move

Here’s the bottom line: Property tax exemptions represent one of America’s most underutilized financial benefits.

Billions in benefits go unclaimed annually due to awareness gaps and administrative barriers that are largely surmountable.

The programs examined in this article can provide $1,000 to $8,000+ in annual savings through strategic application of homestead, senior, veteran, disability, and energy efficiency exemptions.

The key insight? These programs don’t apply automatically. You have to take action.

With proper knowledge, documentation, and strategic application, you can achieve substantial, ongoing tax relief that compounds to tens of thousands in savings over your homeownership journey.

Most critically, the data shows that participation barriers are largely myths. The homeowners who benefit most are those who understand available programs, meet application deadlines, maintain proper documentation, and take advantage of stacking opportunities where multiple programs can be combined.

Your homework for this week: Visit your county assessor’s website or office. Ask about available exemptions. Pick up applications for any programs for which you might qualify.

That property tax bill doesn’t have to be a budget crusher. Take 30 minutes to explore your options. Your future self will thank you when next year’s bill arrives with a lot less sticker shock.

The money is there. The programs exist. The only question is: Will you claim what’s rightfully yours?