Look, I need to tell you something that’s been eating at me since I left my airport job.

You know that sick feeling when you check your bank account after a trip and think, “Wait… how did I spend that much?” Yeah. That’s not an accident.

During my three years working behind the scenes at a major U.S. airport, I watched travelers get nickel-and-dimed in ways that would make a Vegas casino blush. And here’s the kicker: most people have no idea it’s happening.

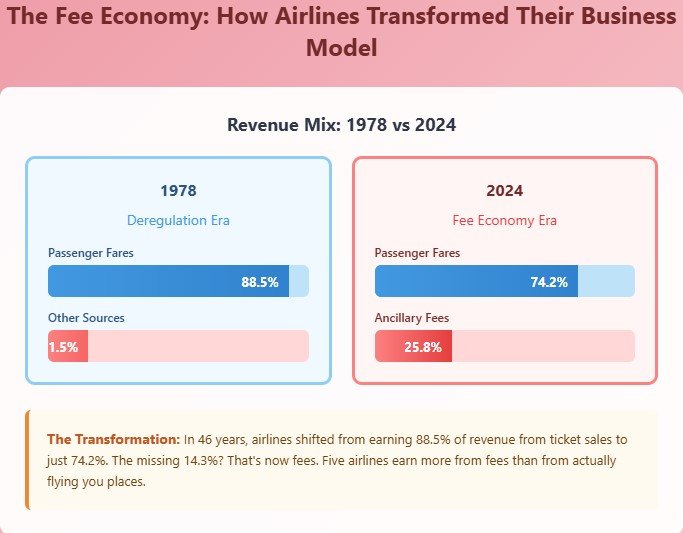

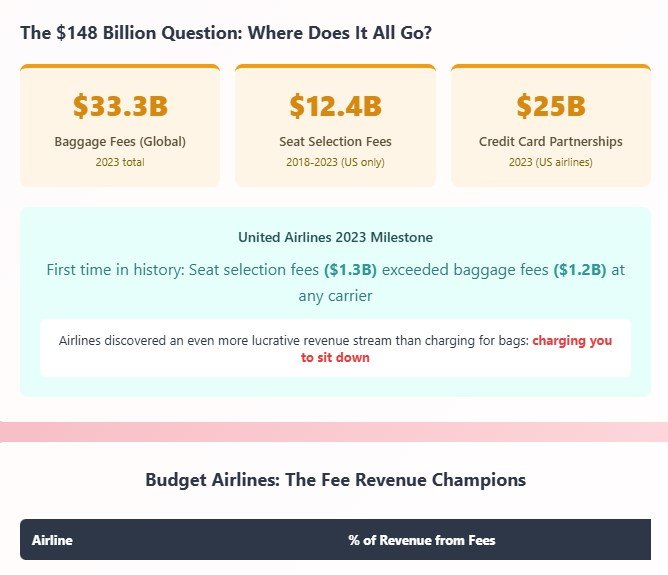

Airlines pulled in $148 billion in fees last year alone. That’s billion with a B. And that’s a 26% jump from the year before.

But here’s what really keeps me up at night—the fees you see advertised (baggage, seat selection) are just the warm-up act. The real money grab? It’s buried so deep in your ticket price that 86% of travelers never even notice they’re paying it.

I’m about to pull back the curtain on nine fees that are draining your wallet right now. More importantly? I’ll show you exactly how to sidestep every single one.

Let’s do this.

Fee #1: The “Security Tax” That Doesn’t Go to Security

Where Your $5.60 Security Fee Really Goes

Annual Impact of Fee Diversion

Did You Know? If fee diversion ended, TSA could deploy cutting-edge facial recognition and screening technology at every US airport within years instead of decades. The money you’re paying for “security” is partly being used to pay down the national debt instead.

Here’s something that’ll make you do a double-take.

Every time you fly—every single time—there’s a $5.60 charge automatically baked into your ticket. It’s called the September 11 Security Fee, and theoretically, it pays for TSA operations.

But here’s the dirty secret: About $1.6 billion of that money each year gets diverted away from airport security entirely. It goes straight to the U.S. Treasury’s general fund to pay down the national debt.

Yep. You’re paying a “security fee” that’s partly just a disguised tax.

Now, I can already hear you thinking, “Okay, but it’s only $5.60. Whatever.” And sure, that sounds small. But here’s the math that shocked even me when I first crunched it:

- The average American family takes one round-trip flight per year

- That’s 4 flight segments (there and back, two people)

- Four people = $44.80 in security fees per trip

- Over 10 years? That’s $448 on something you thought was going to airport security

How to Handle It

Unfortunately, you can’t dodge this one. It’s mandatory on every U.S. flight.

BUT— and this is huge—if you have unused nonrefundable tickets, you can actually get this fee refunded. Most people don’t know this exists.

Call your airline’s customer service and specifically reference “49 C.F.R. § 1510.9(b).” That’s the federal regulation that requires them to refund it. You can claim tickets going back three years.

I’ve recovered $67.20 doing this with old tickets I never flew. Free money sitting in your account.

Fee #2: The “Facility Charge” You Never See

Pop quiz: How much do you think you pay in “Passenger Facility Charges” per flight?

If you answered “I have literally no idea what that even is,” you’re not alone.

This sneaky little charge adds up to $4.50 per flight segment, maxing out at $18 per round-trip. It supposedly funds airport improvements—new runways, terminal renovations, that sort of thing.

The catch? It’s completely invisible as a separate line item on your receipt.

The airports are collecting $3.3 billion annually from this, and most travelers don’t even know they’re paying it. It just gets rolled into your ticket price like it’s no big deal.

Compare that to London Heathrow, which charges $52 in facility fees but actually lists them separately. The transparency is refreshing, even if the price is higher.

Why This Matters More Than You Think

Here’s where it gets interesting.

That facility charge has been frozen at $4.50 since the year 2000. Twenty-five years. No adjustment for inflation. Nothing.

Meanwhile, operating costs for airports have skyrocketed. So how do airports make up the difference?

They charge you for luggage carts.

No, seriously. Ever wonder why luggage carts are free at basically every airport on Earth except in the United States? This is why. U.S. airports can’t raise facility charges (airlines fight it tooth and nail), so they have to get creative.

That $5 cart rental? That’s because of this artificially low cap.

How to Handle It

You can’t avoid the facility charge itself—it’s baked into every ticket.

But the cart fee? Easy. Just refuse to pay it.

Here’s what I do:

- Travel with a carry-on that has wheels (duh)

- If I must check bags, I grab them and immediately head to the curb

- Use a backpack or shoulder bag for my personal items so my hands stay free

The only time I’ve seen carts make sense is if you’re traveling with small kids or have mobility issues. Even then, most airports offer free wheelchair assistance if you request it.

Fee #3: The Boarding Pass Printing Trap (This One Made Someone Get Arrested)

Okay, this one sounds so ridiculous that I wouldn’t believe it if I hadn’t seen it happen with my own eyes.

Budget airlines like Frontier, Allegiant, and Ryanair will charge you—wait for it—$5 to $95 if you show up at the airport without a printed boarding pass or their app already downloaded on your phone.

Let me say that again: They’ll charge you up to $95 to print a piece of paper.

“That’s insane,” you’re thinking. “Nobody would actually pay that.”

Wrong.

In August 2025, a passenger at Florida’s Punta Gorda Airport was arrested after refusing to pay Allegiant’s $5 printing fee. The whole thing escalated because he thought (reasonably!) that printing a boarding pass was just… what airlines do.

The Psychology Behind This Scam

Here’s what makes this fee so effective: it catches you at your most vulnerable moment.

You’re already at the airport. Your flight boards in 45 minutes. You’re flustered. Maybe you’re traveling with kids. Maybe you forgot your phone charger, and your battery’s at 3%.

They’ve got you trapped, and they know it.

The fee is buried on page 37 of the terms and conditions that nobody reads. Then, when you show up unprepared, they hit you with it.

Frontier pockets $25. Ryanair? They’ll hit you for anywhere from €20 to €95, depending on your route.

How to Handle It

This one’s thankfully super easy to avoid:

Download the airline’s app before you leave for the airport. Add your confirmation number. The boarding pass lives in the app.

Don’t want to download yet another app cluttering your phone? I get it. Print the boarding pass at home or at your hotel before you leave.

Set a phone reminder 24 hours before departure—that’s when most airlines let you check in anyway.

I’ll be honest: I still print a paper backup even though I have the app. Call me paranoid, but I’ve watched too many people panic when their phone dies or the app glitches. That $0.10 worth of paper and ink is the cheapest insurance policy you’ll ever buy.

Fee #4: Currency Exchange (AKA Highway Robbery in a Kiosk)

Here’s a fee so predatory that it makes payday lenders look generous.

You know those currency exchange kiosks at airports? The ones with big signs screaming “NO COMMISSION!” and “ZERO FEES!”?

They’re lying to your face.

Well, technically, they’re not lying—they really don’t charge a commission fee. But what they’re not telling you is that they’re embedding 8% to 17% markups directly into the exchange rate itself.

Let me paint you:

You’re traveling to Europe. You need €1,000 for your trip. You walk up to the airport exchange counter.

- The real exchange rate (what you’d find on Google): 1 EUR = $1.08

- The airport’s exchange rate: 1 EUR = $1.20

- You pay: $1,200

- You should pay: $1,080

They just pocketed $120 of your money. For literally typing some numbers into a computer.

A bank would charge you a 2-3% markup—still not great, but we’re talking $20-30 instead of $120.

Why This Keeps Working

The genius of this scam is timing and desperation.

You’ve just landed in a foreign country. You need local currency right now for a taxi or train. You’re jet-lagged. The signs say “no fees.” Your brain says, “Okay, good enough.”

By the time you realize you got ripped off (if you ever realize it), you’re already at your hotel, and it’s too late.

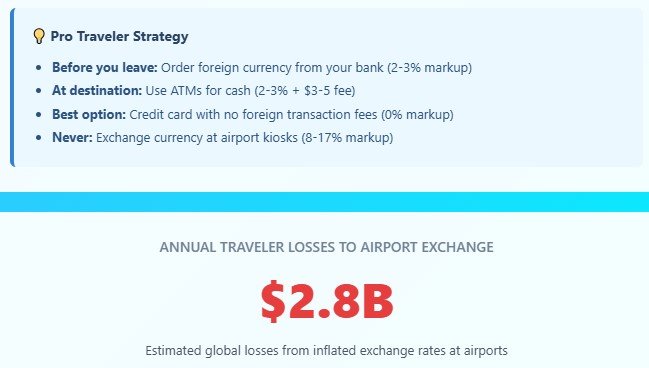

How to Handle It

Step 1: Never, ever, ever exchange currency at an airport. I don’t care how tired you are.

Step 2: Get a credit card with no foreign transaction fees. I use the Chase Sapphire Preferred, but there are tons of options. Capital One cards don’t charge foreign transaction fees at all, even on their basic cards.

Step 3: If you absolutely need cash, use an ATM. Yes, you’ll pay a small withdrawal fee (usually $3-5), but you’ll get the actual market exchange rate. That’s a 2-3% hit instead of 15%.

Pro move: If you know you’re traveling soon, order foreign currency from your bank before you leave. They’ll ship it to you in 3-5 business days at much better rates than airports.

I haven’t touched an airport currency exchange in six years. The money I’ve saved has literally paid for entire hotel stays.

Fee #5: The Baggage Fee Evolution (From $0 to $7.27 Billion)

Let me take you back to May 5, 2008. That’s the day American Airlines became the first major carrier to charge for the first checked bag.

The industry lost its collective mind.

Travel bloggers predicted America would reverse course within weeks. Competitors mocked them in ads. Customers threatened boycotts.

Sixteen years later? U.S. airlines collected $7.27 billion in baggage fees in 2024 alone.

American Airlines didn’t reverse course. They started a gold rush.

The Real Reason This Happened

Here’s what your airline won’t tell you: baggage fees are a genius tax dodge.

When you pay for a plane ticket, the airline owes the government a 7.5% federal transportation tax. That’s just how it works.

But guess what doesn’t get taxed? Baggage fees.

So if your ticket costs $300 and you pay $35 for a checked bag:

- Old system: $335 ticket = $25.13 in taxes

- New system: $300 ticket + $35 bag fee = $22.50 in taxes

The airline pockets an extra $2.63, AND they get to advertise a lower base fare. You lose twice.

Even better (for them): that untaxed fee structure costs the Aviation Trust Fund, which maintains airports and air traffic control—$367 million per year, according to a 2018 RAND study.

The Price Explosion Nobody’s Talking About

In 2008, the first bag fees started at $15. Today?

- American, Delta, United: $35 each way (that’s $70 round-trip)

- JetBlue: $35-45 each way

- Frontier, Spirit: $54-65 if you pay online, $99 at the gate

That gate fee markup is particularly evil. Frontier charges 83% more if you don’t pre-pay. It’s designed to punish you for not reading the fine print.

But here’s where it gets truly insane: Spirit’s “Big Front Seat” fee jumped from $140 in 2018 to $899 in 2023. That’s a 542% increase in five years.

For context, inflation during that same period was about 23%.

How to Handle It

Option 1: The Nuclear Option

Only fly carry-on. I’ve done this for trips up to 10 days. Here’s how:

- Get compression packing cubes (they legitimately cut your luggage volume by 50%)

- Wear your bulkiest shoes and jacket on the plane

- Pack only quick-dry clothing that you can wash in a hotel sink

- Remember the 3-1-1 liquid rule and plan accordingly

One carry-on + one personal item = $0 in baggage fees. Ever.

Option 2: The Credit Card Hack

Get an airline credit card. I know, I know—another credit card. But hear me out.

Cards like the United Explorer Card ($95/year) give you free checked bags for you AND up to 8 companions on the same reservation.

Let’s do the math:

- You + partner take one round-trip per year

- 2 people × 2 bags × 2 flights × $35 = $280 in fees

- The card costs $95

- You save $185

Family of four? You’re saving $465 per year. The card pays for itself in one trip.

Option 3: Southwest Airlines

This feels like shilling, but I promise I don’t work for them: Southwest still offers two free checked bags for everyone. It’s literally the core of their brand.

Yes, their base fares are sometimes higher. But when you factor in bags, the total cost often comes out lower than budget airlines. I’ve price-compared dozens of routes—Southwest wins more often than people think.

Fee #6: The Food & Drink Markup That’s “Technically” Illegal

The Airport Food Tax: Real Prices vs Street Prices

Price Comparison: Same Item, Different Location

Travelers are finally pushing back on inflated prices

Alright, let’s talk about that $17 beer you bought after security.

Most major U.S. airports have something called “street pricing” agreements. These are rules stating that food prices can’t be more than 10-15% higher than the same items would cost outside the airport.

So why does a bagel and a small coffee cost $11.50?

Because nobody enforces these rules. At all.

During my time at the airport, I watched vendors mark up items by 200%, 300%, sometimes more. The compliance audits were a joke—usually just someone checking that the percentage markup was consistent, not whether it was reasonable.

Why Airports Can Get Away With This

Here’s the thing: once you’re past security, you’re trapped.

You can’t leave and come back without going through security again. You’re hungry. Your flight boards in 40 minutes. You’re not going to fight over a $9 turkey sandwich.

They’re counting on your resignation.

The vendors themselves are getting squeezed too, though. Airport rent runs about $80 per square foot—literally double what restaurants pay outside airports. Then, airports take 10-18% commission on every sale.

Those costs get passed straight to you.

The Data That Finally Scared Them

J.D. Power released a study in 2024 that should terrify airport retailers: for the first time, passengers are spending $3.53 per person less at airports than the previous year.

People have hit their breaking point.

Travelers are packing snacks. Eating before security. Straight-up skipping meals rather than pay $23 for a sad airport pizza.

How to Handle It

Before Security:

- Eat a full meal. Like, actually full. Don’t just grab coffee and think you’ll be fine.

- Fill an empty water bottle at a fountain after security (most airports have those bottle-filling stations now)

Pack Your Own Food:

- TSA allows solid foods through security. Sandwiches, fruit, chips, cookies—all fine.

- Wrap anything messy in aluminum foil or plastic bags to make screening easier

- I regularly fly with homemade sandwiches, and nobody’s ever blinked

After Security:

- If you must buy food, hit a chain restaurant where prices are more standardized (they can’t mark up as much because corporate controls pricing)

- Grocery stores inside terminals (like Hudson News) often have better prices than restaurants

- Share items. That $15 sandwich becomes way more reasonable when you split it

Credit Card Lounge Access:

- Premium cards like the Chase Sapphire Reserve or the Amex Platinum give you free airport lounge access

- Lounges have free food and drinks included

- The $450-695 annual fee sounds steep until you realize you’re eating free before every flight

I packed a sandwich for a flight last month. Saved $18. It took me six minutes to make. That’s a $180/hour return on my time. Show me another investment that pays better.

Fee #7: Rental Car “Recovery Fees” (That Recover Costs They Choose to Pay)

Rent a car at an airport and watch what happens to your quote.

You search online: “$263 for the week. Not bad!”

You show up to pick it up. The guy behind the counter prints your receipt.

Final charge: $296.

“What’s this extra $33?” you ask.

“Oh, that’s the Concession Recovery Fee. It covers what we pay the airport to operate here.”

Here’s what makes this fee so shady: It’s not required. It’s not a tax. It’s not even a government charge.

It’s literally just the rental company deciding to pass their business operating costs to you. Then, calling it a “fee” so it sounds official.

Would McDonald’s ever charge you a “Commercial Rent Recovery Fee” on your burger? No. Because that would be insane. That’s just part of their cost of doing business.

But rental car companies get away with it because:

- You’ve already committed to renting the car

- You’re tired from traveling

- It sounds vaguely official

- You need the car right now

The Fee Cascade

That “recovery fee” is just the opening act. Check your rental car receipt closely and you’ll find:

- Concession Recovery Fee: 10-15% of rental cost

- Vehicle License Recovery Fee: $1-3 per day

- Energy Surcharge: $2-5 per rental

- Customer Facility Charge: $2-6 per day

- Airport Facility Fee: Varies wildly by location

Stack them all up, and your actual cost is 15-25% higher than advertised.

How to Handle It

Option 1: Off-Airport Rental Locations

Companies like Enterprise and Hertz have locations just outside the airport property. They’ll pick you up for free. You avoid all the airport-related fees.

I did this in Denver last year. Same car. Same company. Saved $68 on a 5-day rental just by getting picked up at a location 2 miles away.

Option 2: Use Credit Card Coverage

If you’re renting a car anyway, use a credit card that includes rental car insurance. You can decline the rental company’s collision damage waiver (usually $20-35/day).

Most Chase and Amex cards include this. I’ve saved hundreds over the years just by knowing this benefit existed.

Option 3: Price Shop Off-Airport vs. On-Airport

Pull up the rental company’s website. Search the same dates for:

- Airport location

- Nearby off-airport location

I’ve found price differences of up to 30% for the same car from the same company. Takes 90 seconds. Worth every penny.

Fee #8: WiFi Charges (For a Service That Should Be Free)

Airlines charge $8 to $50 per flight for in-flight WiFi.

Let me be very clear about something: the actual cost to provide you with WiFi is borderline negligible. We’re talking pennies per flight.

Gogo, the major in-flight WiFi provider, pays airlines a licensing fee to operate on their planes. Then they charge you for access. The airline gets a cut of every purchase.

It’s a pure profit center built on your desperation to check email or send that one Slack message.

The Captive Market Strategy

Here’s the brilliance of the in-flight WiFi fee: you don’t see the price until you’re already 30,000 feet in the air.

You open your laptop. Try to connect. Get redirected to a payment page. You need to send that email before you land.

They’ve got you.

Delta and United now offer free messaging (iMessage, WhatsApp, etc.) on some flights. Know why? Because once you connect for “free” messaging, you’re one click away from upgrading to full internet. It’s a gateway drug.

How to Handle It

For Frequent Flyers:

Buy a monthly or annual WiFi pass. Gogo offers subscriptions for $69.95/month (unlimited flights) or $599/year. If you fly more than 12 times per year, that’s a better deal than buying one-off passes at $30-40 each.

T-Mobile customers get one hour of free WiFi per flight on Gogo-equipped planes. This is genuinely useful for quick work sessions.

For Occasional Travelers:

Honestly? Just don’t connect.

I know that sounds insane in 2025, but hear me out: you’re on a plane for 2-4 hours. Your emails will survive. Download movies, podcasts, or work documents before you board.

I’ve saved hundreds of dollars over the years by simply… not paying for WiFi. Revolutionary, I know.

At The Airport:

Most major U.S. airports now offer free terminal WiFi. It’s often throttled or ad-supported, but it works fine for email and light browsing.

If you need fast speeds, go to an airport lounge (see credit card discussion earlier). The WiFi in lounges is dramatically better, and it’s included.

Fee #9: Parking (The Silent Wealth Transfer)

Here’s a fee that doesn’t feel like a fee because you kind of expect it.

Park at the airport for a week. Come back. Pay $98 to $133, depending on the airport.

“That’s just what it costs,” you think.

Except it’s not. Not even close.

The Parking Math Nobody Does

Let’s break down what you’re actually paying at a major airport like Atlanta’s Hartsfield-Jackson:

- Daily rate: $14/day

- Weekly rate: $98

- Your car sits there: 168 hours

- Cost per hour: $0.58

Now compare that to off-airport parking:

- Weekly rate at The Parking Spot: $49

- Your car sits there: 168 hours

- Cost per hour: $0.29

Same service. Same security. Literally half the price.

The off-airport lot includes free shuttle service to the terminal. I’ve never waited more than 8 minutes for a shuttle. Usually it’s more like 3-4 minutes.

How to Handle It

Option 1: Off-Airport Parking

Services like The Parking Spot, WayPark, and ParkSleepFly offer rates of $5-25 per week. That’s not a typo.

I use Way App for price comparison. Search your airport. Pre-book online. Done.

Savings example from my last trip:

- Atlanta airport parking: $98/week

- The Parking Spot: $54/week

- Saved: $44

That’s a free dinner out with the money I didn’t burn on parking.

Option 2: Get Dropped Off

If you have family or friends nearby, just get dropped off. An obvious solution, but people forget it exists.

Uber/Lyft can work too if you live close to the airport. I’ve found that rides under 25 minutes usually cost less than a week of parking.

Option 3: Public Transportation

If you’re lucky enough to live near an airport with good transit connections (looking at you, Denver and DC), take the train.

DIA’s A Line costs $10.50 each way = $21 round-trip versus $98 to park. And you don’t have to deal with traffic.

Pro Strategy:

Some hotels near airports offer “Park Sleep Fly” packages. You stay one night before your early morning flight. They let you park for free for up to two weeks.

I’ve done this for 6 am flights. Get a good night’s sleep. Walk to the terminal. Leave my car for 10 days. Total cost: $89 for the hotel night (parking included). Way better than paying $98 for parking alone while also driving at 4 am, half-asleep.

The Bigger Picture: Where Your Money Actually Goes

Okay, we need to talk about something uncomfortable.

You’ve just read about nine fees that are draining your bank account. But here’s what really gets me fired up: a lot of this money isn’t even going where you think it is.

Remember that security fee? $1.6 billion per year gets diverted to the national debt instead of airport security.

The TSA Administrator openly stated that full biometric deployment at U.S. airports could take until 2049 without more funding. You know, funding that should be coming from the security fee you’re already paying.

Baggage fees dodge the 7.5% federal transportation tax, which costs the Aviation Trust Fund (the money that maintains airports and air traffic control) $367 million per year. That’s money that should be maintaining the infrastructure you’re using.

The Credit Card Money Bomb

Here’s something that blew my mind when I learned it:

U.S. airlines generated approximately $25 billion from co-branded credit cards in 2023. Delta alone pulled in $6.8 billion from its American Express partnership.

Think about that. Delta made more money selling miles to Amex than many airlines make from actually flying passengers.

This explains so much about how airlines operate now. Your loyalty to them as a passenger almost matters less than your loyalty to their credit card. Elite status perks, lounge access, free bags—these aren’t rewards for flying. They’re rewards for holding the right credit card.

What’s Actually Changing (And What Isn’t)

In April 2024, the Department of Transportation finalized rules that would have required airlines to show you all fees upfront—no more hiding them behind hyperlinks or separate pages.

The airlines sued immediately.

American, United, Delta, Alaska, Hawaiian, JetBlue, and their trade association, Airlines for America, filed suit on May 10, 2024. They argued it would cost “millions” to update their websites.

They won. The rules are blocked as of January 2025.

Let me be crystal clear about what happened here: Airlines spent millions on lawyers to avoid spending millions on website updates that would have made prices transparent to you.

The message is obvious: they make more money when you’re confused.

What Did Survive

The automatic refund rule made it through. As of October 2024, airlines must give you cash refunds within 7 business days for:

- Canceled flights

- Significantly delayed flights (3+ hours domestic, 6+ international)

- Delayed baggage (12+ hours domestic, 15-30 international)

- Services you paid for but didn’t receive (WiFi, seat selection, etc.)

This is actually huge. Before this rule, airlines would offer vouchers or credits instead of refunds. Now you get real money back.

Enforcement matters too. Between 2021 and 2024, the DOT assessed over $164 million in penalties against airlines—more than double the entire previous 24 years combined.

Southwest got hit with a $140 million fine for its December 2022 holiday meltdown. The DOT helped return over $3 billion in refunds to passengers during Biden’s term.

But the industry is fighting back hard. Airlines for America released a 93-page wish list in late 2024 seeking to roll back not just fee transparency, but automatic refunds, family seating protections, and accessibility improvements.

The war isn’t over. It’s just getting started.

Your Action Plan (Actually Useful Steps)

Alright, enough doom and gloom. Let’s talk about what you can actually do about all this.

I’ve organized this by impact level—biggest savings first.

High Impact (Save $500+ per year):

Get the right credit card. I know I’ve harped on this, but it’s genuinely the single highest-ROI move:

- Airline card for free bags: $280/year savings (family of four, one roundtrip)

- Premium travel card for lounge access: $300-500/year value (free food, drinks, WiFi)

- Cards with travel credits: $200-300/year in automatic statement credits

Start with one card. Master it. Then consider adding another if it makes sense.

Book off-airport parking: $44-110 per trip saved. Takes 5 minutes to book online.

Master the carry-on. Get compression cubes. Practice packing light. Save $70 per round-trip.

Medium Impact (Save $100-300 per year):

Pre-purchase checked bags online (if you must check): $30-45 saved per bag versus gate pricing

Pack food for the airport: $15-25 saved per trip

Use ATMs instead of currency exchange: $50-100 saved on international trips

Download airline apps before the airport: $5-95 saved (and avoid potential arrest)

Low Impact But Still Free Money:

Claim refunds on unused tickets: TSA fee ($5.60 per segment) can be refunded. Check your email for old unused tickets.

Request weather delay compensation: Airlines aren’t required to pay for weather delays, but if you ask nicely and have elite status or the right credit card, they often throw you a voucher anyway.

Sign up for airline newsletters: You’ll get occasional discount codes and alerts when fees are being waived (rare, but it happens).

The 24-Hour Rule Hack

This one deserves its own section because it’s pure gold:

All U.S. airlines must offer free cancellation within 24 hours if you book at least 7 days before departure.

Use this to lock in prices while you finalize plans:

- See a good fare? Book it immediately.

- Sleep on it. Research. Compare.

- Within 24 hours, cancel for a full refund if you find better.

I do this constantly. I’ve rebooked flights after prices dropped $100 the next day. I’ve canceled flights when plans changed with zero penalty.

It’s risk-free price insurance.

The Uncomfortable Truth

Here’s what I’ve learned after three years in the industry and seven years of obsessively tracking this stuff as a traveler:

The fee economy isn’t going away.

Airlines collected $42.6 billion in ancillary fees in 2013. By 2024, that number hit $148.4 billion. That’s a 248% increase in 11 years.

Five airlines now earn more from fees than from ticket sales. Frontier makes 62% of its revenue from fees. Spirit sits at 58.7%.

These aren’t side hustles anymore. This is their business model.

Are the old days of comparing flight prices and picking the cheapest one? Those days are gone. You have to calculate the total trip cost now:

- Base fare

- Bags (if any)

- Seats (if you care)

- Parking or airport transportation

- Food (if you’re not packing)

- Any other random fees the airline dreams up

But Knowledge Is Power

Here’s the good news: most travelers still don’t know about 90% of what I’ve shared in this post.

They pay $99 for a bag at the gate when it would’ve been $54 online.

They exchange currency at airport kiosks and lose 15%.

They park on-site and pay double what off-airport lots charge.

They buy $17 beers when they could’ve packed a sandwich.

You now know better.

The airlines and airports built this fee labyrinth because complexity favors them. Every extra click, every confusing policy, every buried charge—it all generates revenue from passengers who are confused, rushed, or simply don’t know they have options.

You’re not confused anymore.

One Last Thing

I spent three years watching travelers get nickel-and-dimed at airports. The number of people I saw argue with gate agents over fees they didn’t know existed? Thousands.

The number of people I saw actually avoid those fees because they knew the tricks? Maybe a few hundred. Maybe.

The gap between those two groups isn’t intelligence. It’s not wealth. It’s not frequent flyer status.

It’s information.

You now have that information.

The question is: what are you going to do with it?

Next time you book a flight, open a second browser tab. Search for off-airport parking. Check if your credit card offers free bags. Download the airline app before you leave home. Pack a sandwich. Bring an empty water bottle.

These aren’t life-changing moves individually. But stack them all up? You’ll save hundreds per trip, thousands per year.

And honestly? There’s something deeply satisfying about walking past those $17 beer stands knowing you’ve got a homemade sandwich in your bag and you paid half what everyone else did for parking.

The system is designed to extract maximum money from people who don’t know better.

You know better now.

Safe travels, and may your bags always be free. ✈️

Have your own airport fee horror story or a hack I missed? I’d love to hear it. Drop a comment below—I read every single one.