You just booked what seems like an amazing deal for your family vacation. The flights were only $300 each, the hotel looked perfect at $89 per night, and you’re already dreaming about those Instagram photos.

Then reality hits at checkout.

Suddenly, that “cheap” flight needs seat selection fees so your family can sit together. The hotel tacks on a mysterious $45 “resort fee.” Your rental car quote just tripled with insurance you probably don’t need.

Sound familiar?

You’re not alone, and you’re definitely not imagining things. The average American family loses between $3,050 and $4,100 every single year to these seemingly innocent travel mistakes.

That’s not a typo. We’re talking about enough money to fund an entire extra vacation – money that’s slipping through your fingers because the travel industry has become incredibly good at hiding costs and exploiting our blind spots.

Here’s what nobody tells you: these aren’t random bad luck incidents. They’re systematic traps designed to extract maximum cash from unsuspecting travelers. But once you know how they work, you can completely avoid them.

Ready to stop bleeding money? Let’s dive in.

The Great Resort Fee Scam (And Why It Makes Me Mad)

🏨 Resort Fees by City: The Worst Offenders

What Resort Fees “Include” vs Reality

Let me tell you about the most infuriating travel scam that’s somehow completely legal.

Americans pay $3 to $4 billion annually in hotel resort fees. That’s billion with a “B.” These fees average $35 per night and – here’s the kicker – they never appear in the advertised room rate.

I learned this the hard way in Las Vegas. Saw a room at the Luxor for $23 per night. Amazing deal, right? Wrong. At checkout, they hit me with a $45 daily resort fee. I was literally paying more in fees than for the actual room!

This isn’t just Vegas being Vegas. It’s everywhere now.

In New York City alone, these fees exploded from 15 hotels in 2016 to over 125 by 2020. That’s a 733% increase in four years.

Why Hotels Get Away With This

The psychology is brutal and brilliant. Hotels know that two-thirds of travelers abandon bookings when surprised by unexpected fees at checkout. So they hide the mandatory costs until you’re emotionally invested.

You’ve already:

- Told your kids about the pool

- Planned your itinerary

- Maybe even requested time off work

Walking away feels impossible, even when that $100-per-night rate becomes $145 overnight.

The Good News (Finally!)

The FTC just dropped a new “Junk Fees Rule” that takes effect in May 2025. Hotels will finally have to show you the real price upfront.

Until then, here’s your defense strategy:

- Always add $30-50 per night to any hotel rate for realistic budgeting

- Search for “resort fee” + the hotel name before booking

- Consider booking directly with hotels that explicitly advertise fee-inclusive pricing

- Ask about fees when calling hotels directly – sometimes they’ll waive them

Flight Booking: The $500 Timing Mistake You’re Probably Making

Quick question: When do you usually book your flights?

If you’re like most people, you probably book either:

- Super early (because you heard that’s cheaper)

- Last minute (because life got busy)

Both approaches are costing you serious money.

The Real Numbers Behind Flight Pricing

Here’s what actually happens:

Domestic flights: Book exactly 28 days out for the best prices. Not 30, not 25. Twenty-eight days.

International flights: The sweet spot is 60 days ahead. Booking 3-4 months early (like everyone says) actually costs you 8% more.

Last-minute booking penalty: If you wait until the last two weeks, you’re paying roughly 30% more than necessary.

Let me put this in real money terms. On a $1,000 international trip, that timing mistake costs you $300. For a family of four? We’re talking $1,200 down the drain.

The Secret Airline Pricing Patterns

Airlines change prices every 4.5 days on average, with each adjustment averaging $33 up or down. They’re using dynamic pricing algorithms that update up to 15 times daily on popular routes.

Even crazier? They might be tracking your browsing history and raising prices when you return to the same booking.

Here’s your flight booking cheat sheet:

- Best day to book: Sunday (up to 15% cheaper than Friday)

- Best time to book: Tuesday at 3 PM Eastern

- Best days to fly: Tuesday or Wednesday (12% cheaper than weekends)

- Set up price alerts on Google Flights, Kayak, and Hopper

- Clear your browser cookies or use incognito mode when price shopping

Travel Insurance: The $60,000 Gamble You Can’t Afford to Lose

I’ll be honest – travel insurance feels like a waste of money until you desperately need it.

Here’s a number that should wake you up: The highest travel insurance medical claim in 2024 was $61,976. That’s enough to buy a luxury car, and it represents exactly what one family faced when their vacation went wrong.

Most people think, “That’ll never happen to me.” But consider this:

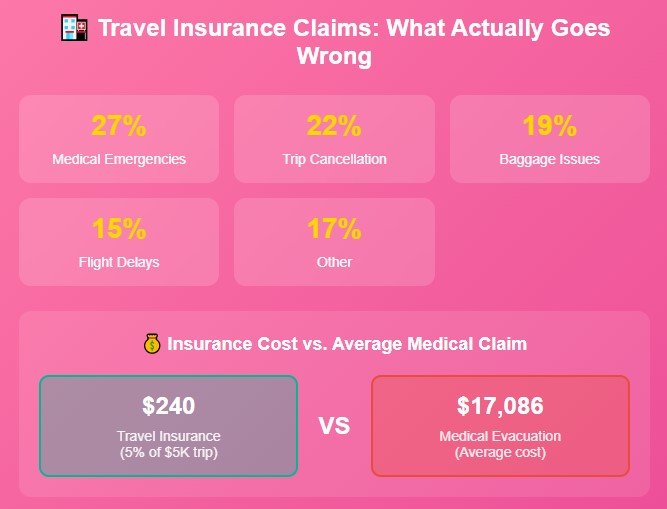

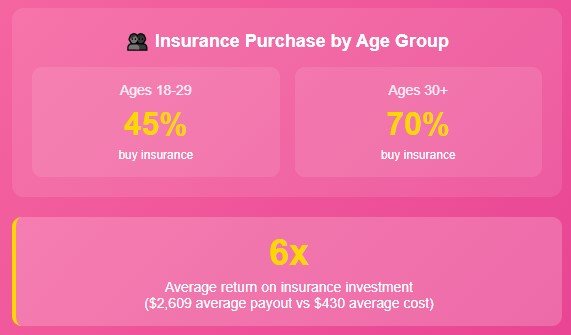

- Average claim payout in 2024: $2,609 (up 37% from 2023)

- Average insurance cost: 4-10% of your trip cost

- Return on investment: Insurance pays out six times its cost in average claims

When Vacation Medical Bills Destroy Bank Accounts

Emergency medical claims became the #1 expense category for the first time ever in 2024. They now represent 27% of all travel insurance claims.

Medical evacuation claims average $17,086 per incident. Without insurance, this comes straight from your savings account.

The age gap here is terrifying: Only 45% of travelers ages 18-29 buy travel insurance, compared to 70% of older travelers. Younger people are essentially gambling their financial futures on nothing going wrong.

Here’s when you absolutely need travel insurance:

- International trips (medical costs can be astronomical)

- Expensive trips (anything over $2,000)

- Adventure activities (skiing, diving, hiking)

- Traveling during hurricane/weather seasons

- If you have pre-existing health conditions

Pro tip: Most policies must be purchased within 14 days of your initial trip deposit to provide maximum coverage. Wait too long, and you lose protection for the most common claim reasons.

Your Credit Card Is Quietly Taxing Every International Purchase

Let’s talk about the hidden tax you’re probably paying on every international transaction.

Standard foreign transaction fees range from 1% to 3% of every purchase. That means your $3,000 European vacation automatically costs an extra $30 to $90 in fees – just for the privilege of using your card abroad.

But it gets worse.

The ATM Fee Nightmare

ATM fees hit a 26-year high in 2024, averaging $4.77 per withdrawal. If you’re someone who hits the ATM once a week throughout the year, you’re wasting $237 annually in fees alone.

When you’re traveling internationally, these fees often double or triple because you’re paying:

- Your bank’s foreign ATM fee

- The foreign ATM’s fee

- Currency conversion fees

I’ve seen single ATM withdrawals cost $15-20 in combined fees. That’s insane.

The Rewards You’re Leaving on the Table

Here’s another kick in the gut: 23% of credit cardholders failed to redeem their earned rewards in the past year. That’s literally leaving hundreds of dollars on the table.

Meanwhile, savvy travelers are earning 2% to 5% back on all travel purchases using the right credit cards, essentially getting paid to travel.

The Dynamic Currency Conversion Trap

When you’re abroad and a merchant asks if you want to pay in dollars instead of local currency, always say NO. This “convenient” service typically costs you double the standard foreign transaction fee.

Your credit card game plan:

- Get a no-foreign-transaction-fee card before traveling (Chase Sapphire, Capital One Venture, Bank of America Travel Rewards)

- Research your current cards’ fee structures

- Set up automatic rewards redemption

- Always pay in local currency abroad

- Use ATMs affiliated with major banks to minimize fees

Rental Cars: Where a $200 Quote Becomes $872

🚗 How a $200 Rental Becomes $872: The Complete Fee Breakdown

The Price Explosion in Action

(per week)

(after all fees)

Insurance Upsells

- Collision Damage Waiver $9-15/day

- Liability Coverage $30/day

- Personal Accident $8/day

- Personal Effects $6/day

Location & Add-On Fees

- Airport Premium 17% markup

- GPS System $16/day

- One-Way Fee $100-500

- Fuel Service $20-30

- Cleaning Fee $150+

👶 Age Discrimination Surcharges

You likely already have coverage through auto insurance or credit cards

Rental car companies have turned fee extraction into an art form. That innocent $200-per-week rental can easily become $872 after all the add-ons.

That’s a 336% increase over the advertised rate. Let me show you how they do it.

The Insurance Overlap Scam

This is the big one. Rental companies will try to sell you:

- Collision Damage Waiver: $9-15 per day

- Liability coverage: $30 per day

- Personal accident insurance: $8 per day

- Personal effects coverage: $6 per day

Here’s what they don’t tell you: You probably already have this coverage through:

- Your personal auto insurance

- Your credit card benefits

- Your health insurance

Before your next rental, call your insurance company and credit card company to understand exactly what you’re already covered for. Most people are paying for duplicate insurance they don’t need.

Age Discrimination and Location Penalties

If you’re under 25, get ready for a daily surcharge of $27 to $35 at major companies. That’s $189 to $245 extra for a week-long rental just for being young.

Renting at airports or downtown locations? Automatic 17% location premium because they know you don’t have other options.

The Ridiculous Add-On Fees

- GPS: $16 per day (despite everyone having smartphones)

- One-way rental fees: Can reach hundreds of dollars

- Fuel service charges: $20-30 if you don’t return with a full tank

- Cleaning fees: $150+ for minor dirt or food residue

How to beat the rental car game:

- Research your existing insurance coverage before traveling

- Decline unnecessary add-ons confidently

- Consider car-sharing services (Zipcar, Turo) for urban trips

- Book directly with rental companies instead of third-party sites

- Take photos of the car before and after your rental

Transportation Choices That Drain $2,000 Per Year

Here’s a statistic that might surprise you: Americans spend 16% of their household income on transportation compared to Europeans’ 11%. That 5% difference costs the average household about $2,000 annually.

Why such a huge gap?

The Public Transit Opportunity Most Americans Miss

Nearly 45% of Americans have no access to public transportation, forcing expensive private vehicle dependence. But even in cities with great transit options, only 2% of Americans use public transit for commuting versus 10-20% in Western Europe.

When you travel, this pattern continues. You’ll automatically default to expensive transportation options without researching alternatives.

Real example: Getting from Newark Airport to Manhattan:

- Rideshare: $50-80 (surge pricing)

- Taxi: $50-70

- Airport train: $13

- Bus: $16

That’s a $40-65 difference for the same destination. Multiply this across all your travel transportation decisions, and the money adds up fast.

The Rideshare Subsidy Trap

Uber controls 76% of the U.S. rideshare market by subsidizing about 50% of ride costs. This creates artificially low prices that hurt public transit development while training consumers to choose expensive convenience.

Most rideshare trips (20-40%) have viable public transit alternatives, but riders consistently choose convenience over savings.

Smart transportation strategies:

- Research public transit options before arriving at your destination

- Download local transit apps (Citymapper is great for major cities)

- Consider walking for trips under 1 mile (often faster than waiting for rides)

- Use bike-sharing programs in bike-friendly cities

- Split longer rideshare trips with other travelers when possible

The Hidden Booking Platform Tax

Every time you book through Expedia, Booking.com, or similar platforms, you’re paying a 10% to 25% markup that gets buried in the pricing.

Here’s how they hide it:

The Commission Structure Nobody Talks About

Airbnb charges guests 14.1% to 16.5% in service fees, plus hosts pay an additional 3% commission. That’s nearly 20% in total fees on every booking.

Hotel booking platforms work similarly. Booking.com takes 15% commissions that hotels pass through to consumers in marked-up rates.

You’re paying for the “convenience” of one-stop shopping, but is it worth hundreds of dollars per year?

Why Price Match Guarantees Are Worthless

These platforms love to advertise price match guarantees, but read the fine print. The exclusions make them virtually worthless when you actually need them:

- Different room types

- Different cancellation policies

- Member-only rates

- Package deals

- Different dates (even by one day)

The Direct Booking Advantage

When you book directly with hotels or airlines, you often get:

- Better customer service

- Loyalty program benefits

- Room upgrade opportunities

- Easier changes and cancellations

- Lower rates (hotels save the commission)

Platform vs. direct booking strategy:

- Use platforms for research and comparison

- Always check the hotel/airline website for direct booking rates

- Call the hotel directly and ask if they can match or beat the platform price

- Book directly when prices are equal for better service and benefits

When These “Innocent” Mistakes Add Up to Financial Disasters

📊 The $3,850 Annual Mistake Calculator

How Individual Mistakes Add Up

🏖️ What $3,850 Could Buy Instead

flights + hotels included

or 3 weeks Thailand

5-star resort included

throughout the year

📈 The 10-Year Compounding Disaster

with proper knowledge and planning

Let me show you how these seemingly small decisions compound into massive, unnecessary expenses.

Real family vacation scenario:

The Johnson family planned a 4-day domestic trip with these “innocent” choices:

Flight booking mistakes:

- Base airfare (booked 2 weeks out): $1,200

- Seat selection to sit together: $200

- Checked bags: $280

- Carry-on fees (budget airline): $360

- Priority boarding for overhead space: $120

- Extra cost from poor planning: $960

Hotel booking mistakes:

- Advertised rate: $100/night × 4 nights = $400

- Hidden resort fees: $45/night × 4 nights = $180

- Parking fees: $25/night × 4 nights = $100

- Extra cost from hidden fees: $280

Other compounding costs:

- Rental car insurance overlap: $180

- Foreign transaction fees: $120

- Wrong credit card (missed rewards): $150

- Poor transportation choices: $200

Total unnecessary expenses: $1,890

Their “budget” vacation became 150% more expensive than planned. That’s almost enough for a second vacation entirely.

The Psychology Behind Why Smart People Make Expensive Mistakes

Why do normally frugal, intelligent people suddenly start throwing money around when they travel?

The “Vacation Brain” Effect

McKinsey research found that anticipating travel creates higher happiness than the actual journey. This emotional high leads to overspending during planning phases when excitement overwhelms rational financial analysis.

“Vacation brain” creates cognitive biases that make you accept prices and fees you’d never tolerate in daily life. The combination of:

- Time pressure (limited vacation days)

- Emotional investment (dream destinations)

- Complexity (multiple vendors and fee structures)

Creates perfect conditions for expensive mistakes.

Social Media and FOMO Spending

88% of Gen Z follows travel influencers, creating FOMO-driven spending that prioritizes lifestyle signaling over financial efficiency. Despite being labeled “budget-conscious,” Gen Z travelers spend $11,766 annually on trips.

Decision Fatigue Is Expensive

Planning a major trip involves hundreds of micro-decisions about flights, hotels, transportation, and activities. By the time you reach booking, mental exhaustion makes you more likely to accept default options and pay convenience fees rather than optimize for savings.

Your Action Plan: How to Stop the Money Bleeding

The good news? These costs are systematic, which means they’re systematically avoidable.

Start With the Big Four

These changes alone can save $500-1,000 per trip:

- Use no-foreign-transaction-fee credit cards

- Book flights 28-60 days ahead

- Research hotel fees before booking

- Decline unnecessary rental car insurance

Develop Timing Discipline

- Track prices using alerts on Google Flights, Kayak, and Hopper

- Book on optimal days (Sunday for flights, Tuesday for travel)

- Resist last-minute convenience booking

- Remember: every day you wait can cost $33 on average

Question Every Fee and Add-On

The moment you start asking “Is this necessary?” and “What alternatives exist?” you begin clawing back hundreds in wasteful spending.

Resort fees, insurance overlaps, platform markups, and transportation premiums all profit from consumer passivity.

Build Your Travel Money Defense System

Before your next trip:

✅ Apply for a travel rewards credit card with no foreign fees

✅ Research your existing insurance coverage

✅ Download price tracking apps

✅ Learn your destination’s public transportation options

✅ Set price alerts for flights 2-3 months before travel

✅ Calculate true hotel costs including fees

The Bottom Line: Your Money, Your Choice

The travel industry’s fee structure evolved to extract maximum revenue through consumer confusion and limited transparency. These “innocent” mistakes aren’t innocent at all – they’re a systematic transfer of wealth from your family’s budget to corporate profit margins.

But here’s the empowering truth: once you understand how these systems work, you have complete control over whether you participate in them.

Your next vacation doesn’t have to cost $2,000+ in avoidable mistakes. Armed with this knowledge, you can stop funding the travel industry’s fee extraction system and start keeping that money for what really matters.

Imagine having an extra $3,000 per year for travel. That’s enough for an additional vacation, better accommodations, or experiences you previously thought were out of reach.

The choice is yours. Will you keep paying the hidden travel tax, or will you join the growing number of informed travelers who refuse to be taken advantage of?

Start implementing these strategies on your next trip. Your bank account will thank you, and you might just discover that the best part of travel isn’t the destination – it’s the satisfaction of outsmarting a system designed to separate you from your money.

What’s the first change you’ll make on your next trip? Pick one strategy from this guide and commit to implementing it. Every dollar you save is a dollar you can spend on creating better memories instead of padding corporate profits.