Hey there, future homeowner (or current one who’s starting to sweat a little).

Let me ask you something: What if I told you that 21 out of America’s 33 biggest housing markets are already trading below their 2022 peaks? And that’s just the warm-up act.

I’ve been digging deep into the data, talking to experts, and honestly? What I found made my stomach drop. We’re not looking at another 2008-style nationwide collapse, but certain cities are walking straight into a real estate buzz saw in 2026.

Some places are already getting hammered. Others are teetering on the edge. And if you’re thinking about buying, selling, or just want to sleep better at night, you need to know which is which.

The Great Expert Divide: Crash vs. Boom

Expert Battle: 2026 Housing Predictions

Who’s calling it right?

CRASH CAMP

BOOM BELIEVERS

📊 CURRENT MARKET REALITY

On one side of the ring, you’ve got Graham Stephan (the guy with 4.75 million YouTube subscribers who called the last downturn). He’s practically shouting that 2026 is going to be brutal.

His reasoning? We’ve got the worst affordability in 40 years, record-high prices, and way too much supply hitting markets that got drunk on pandemic migration.

In the other corner? Lawrence Yun from the National Association of REALTORS® is basically saying “Hold my beer” and predicting a 13% jump in home sales and 4% price increases for 2026.

So who’s right?

Well, there’s this British economist named Fred Harrison who’s got a pretty good track record. He predicted both the 1990 and 2008 crashes over a decade before they happened. His secret? An 18-year real estate cycle that’s been running like clockwork since the 1800s.

Guess where we are in that cycle? Yep, right at the 2026 peak.

Austin: The Canary in the Coal Mine

Let’s talk about Austin for a hot minute, because this city is basically showing us the future.

Austin home prices are down 23.4% from their June 2022 peak. That’s not a correction. That’s a full-blown crash in progress.

Remember when Austin was the hottest tech hub outside Silicon Valley? Tesla, Oracle, everyone was moving there. Well, Tesla laid off 2,688 people. Oracle moved its headquarters. Microsoft, Intel, and Bumble all made massive cuts.

Now, homes are sitting on the market for 66 days (the second-worst in the nation), and people are literally fleeing. Austin led Texas in mass layoffs, accounting for 20% of the entire state’s job losses.

If you bought at the peak in Austin, you’re underwater. Deep underwater.

Miami’s Perfect Storm (And It’s Not Pretty)

Now let’s fly down to Miami, where things are getting weird in a different way.

UBS just ranked Miami as the #1 bubble risk in the entire world. Not just America. The world.

Here’s what’s happening:

- Homes are 20.3% overvalued compared to historical norms

- It takes 69 days to sell a house (the longest in the nation)

- Inventory is piling up like Hurricane debris

But wait, it gets worse. 100% of Miami properties face severe wind risk. Half face flood risk. Nearly all face extreme heat risk.

You know what that means? Insurance companies are running for the hills. Those beautiful waterfront condos? Good luck getting coverage that doesn’t cost more than your mortgage.

Oh, and here’s the kicker: Miami lost 16,781 residents to other states last year. When people start fleeing paradise, you know something’s wrong.

Texas: When the Whole State Gets Wobbly

I hate to be the bearer of bad news for Texas, but every major market in the Lone Star State is flashing warning signs.

Austin: Already crashed (-23.4%). San Antonio: Down 9.4% from peak, 62 days on market. Dallas-Fort Worth: Down 7.1% from peak. Houston: 12-year high inventory levels

What happened? These cities rode the pandemic wave hard. Remote work migration, corporate relocations, and everyone moving to Texas for lower costs and no state income tax.

Turns out, when the remote work party ends and companies start calling people back to the office, all those new Texas residents start having second thoughts.

Florida’s Insurance Apocalypse

Florida used to be where people went to retire and enjoy the sunshine. Now it’s becoming uninvestable.

Tampa: Down 4.9% from peak with a 3.6% yearly decline. Miami: 7.2 months of supply sitting on the market. Cape Coral: Home sales dropped 9% year-over-year

The real problem? Try getting homeowner’s insurance in Florida that doesn’t require you to sell a kidney. Hurricane damage costs are through the roof, coverage is disappearing, and climate scientists are warning that storms are getting worse every year.

Cape Coral is particularly scary because it was ground zero for the 2008 subprime crisis. Seeing similar patterns emerge there should make everyone nervous.

The Small Cities Getting Obliterated

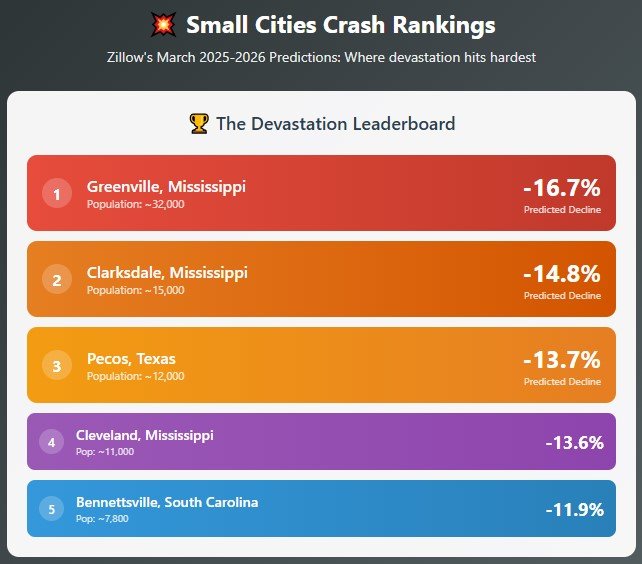

While everyone’s watching the big metros, Zillow’s projections for smaller cities are absolutely brutal:

- Greenville, Mississippi: -16.7% predicted decline

- Clarksdale, Mississippi: -14.8%

- Pecos, Texas: -13.7%

- Cleveland, Mississippi: -13.6%

- Bennettsville, South Carolina: -11.9%

These aren’t statistical noise. These are economic disasters waiting to happen in communities that can least afford them.

Why 2026 Isn’t Random

⏰ The 18-Year Real Estate Cycle

Why 2026 isn’t coincidence—it’s mathematical precision

📈 Historical Cycle Timeline

🎯 The Cycle Prophets

• 1990 crash (1970s prediction)

• 2008 crash (1997 prediction)

• Pattern since 1800s

• Only 2 exceptions (WWII, Fed shock)

⚙️ How the Cycle Works

& Growth

Builds

Formation

Reset

📊 2026 Pattern Evidence

(2021-2022)

(Worst in 40yrs)

(Austin -23.4%)

Remember that 18-year cycle I mentioned? It’s not just theory.

The pattern holds: Major peaks in 1979, 1989, 2006… and now we’re staring down 2026.

The 2008 crash happened exactly 18 years after the 1990 downturn. Economist Fred Foldvary actually predicted the 2008 crash in 1997 using this exact cycle.

History doesn’t repeat, but it sure does rhyme.

When Industries Collapse, So Do Home Values

Here’s what’s really scary: Austin’s just the beginning.

Seattle is seeing cracks despite being more diversified than Austin. Amazon cut 2,300 jobs. Microsoft axed 900. Google eliminated 7,000 positions statewide.

Las Vegas is hemorrhaging tourists for six straight months. Gaming revenue is down. When your economy runs on people visiting and having fun, having them stop showing up is a death sentence.

Even Washington, D.C. could be in trouble. With potential federal workforce cuts of 600,000-750,000 employees, what happens to home values when a quarter of your buyers disappear?

The Millennial Surprise Nobody Saw Coming

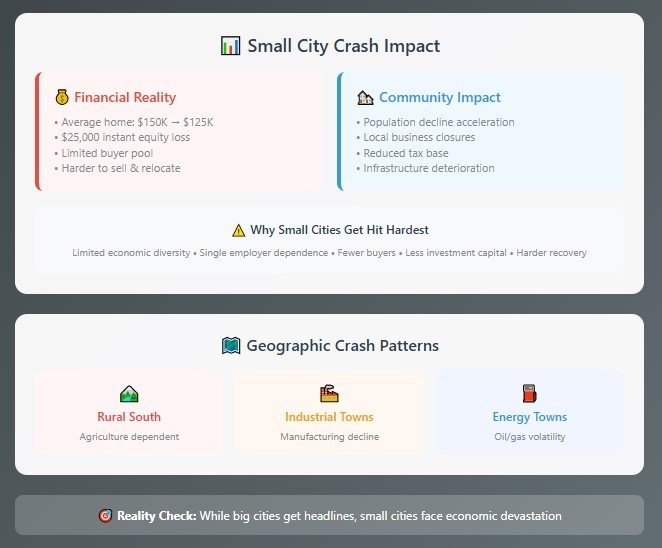

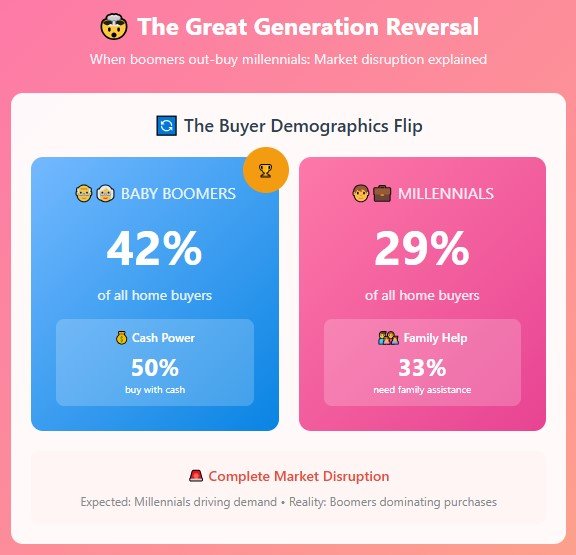

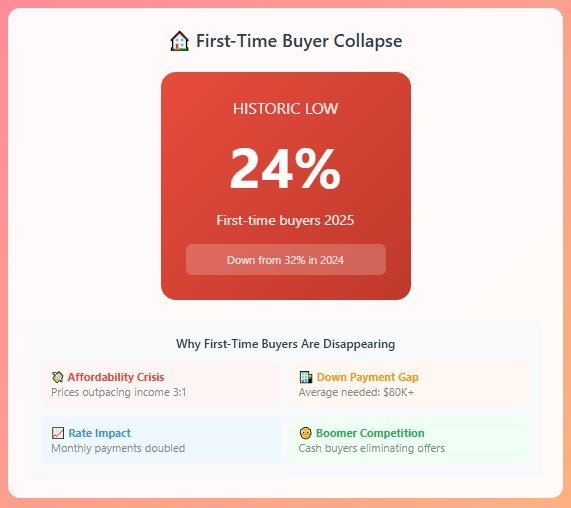

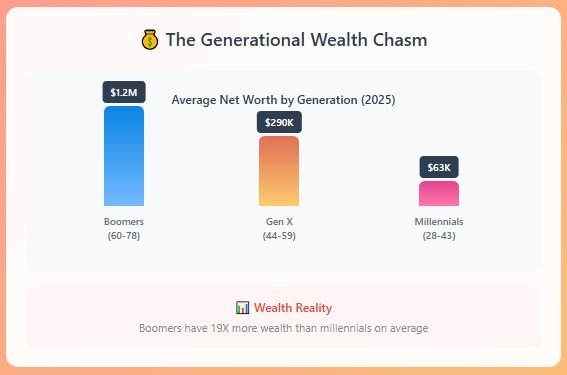

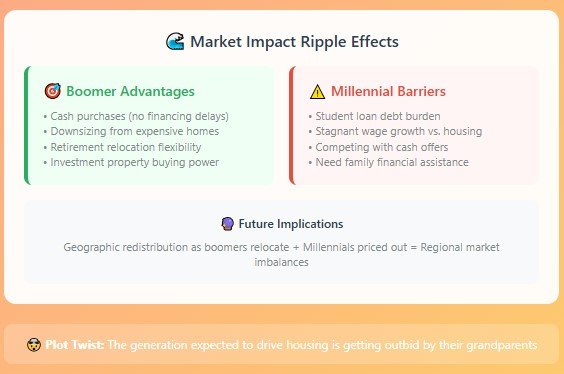

Here’s a stat that’ll blow your mind: Baby boomers now represent 42% of home buyers versus just 29% for millennials.

Wait, what? Weren’t millennials supposed to be driving the housing market for the next decade?

Turns out, boomers are buying with cash (50% of older boomer purchases), while millennials are getting priced out or need mommy and daddy’s help for down payments (33% require family assistance).

First-time buyers have dropped to a historic low of 24%. When the people who are supposed to be driving demand can’t afford to participate, what do you think happens to prices?

Your Real Estate Action Plan

If you’re thinking about buying in Austin, Miami, or Texas: Stop. Just stop. Wait 12-24 months and see how this plays out. The correction is just getting started.

If you own in one of these markets, Time for some honest self-reflection. Are you planning to stay long-term? If not, consider your exit strategy now while you can still get decent prices.

If you’re an investor: The opportunities are coming, but don’t try to catch falling knives. Wait for clear bottoms and focus on markets with diverse economies and supply constraints.

For everyone else: This isn’t 2008. The financial system is stronger, lending standards are tighter, and it won’t be nationwide. But regional crashes can still create amazing buying opportunities if you’re patient.

The Bottom Line: Geography Is Destiny

🗺️ The 2026 Crash Map

Where you live determines your real estate fate

🎯 Regional Crash Probability Map

🏆 Winners vs 💥 Casualties

THE CASUALTIES

• Austin: -23.4%

• Miami: UBS #1 global risk

• Tampa: -4.9% from peak

• Phoenix: Population exodus

• Las Vegas: Tourism collapse

• San Antonio: -9.4% from peak

• Small TX cities: -10% to -16%

THE SURVIVORS

• San Francisco: Supply constraints

• Boston: Economic diversity

• Chicago: Affordable baseline

• Portland: Regulated growth

• Limited new construction

• Multiple industries

• Climate advantages

• Stable demographics

🔍 The Crash Patterns

• Pandemic boom-bust cycle

• Climate vulnerability

• Speculation-driven pricing

• Elastic housing supply

• Remote work reversals

• Supply-constrained markets

• Climate resilience

• Sustainable growth patterns

• Zoning restrictions

• Stable employment base

⏰ The 2026 Timeline

Look, I’m not trying to scare you. I’m trying to prepare you.

The 2026 real estate reckoning won’t hit everywhere. It’ll hit the places that got too greedy, too dependent on single industries, or too willing to ignore climate reality.

Austin’s already showing you what happens when a tech boom goes bust. Miami’s about to teach us about climate risk and insurance costs. Texas is learning that oil booms and migration waves both end eventually.

The crash map is being drawn right now. Austin (-23.4%) is your preview. Miami, Tampa, Phoenix, Las Vegas, and parts of Texas are next in line.

The question isn’t whether these corrections will happen. The question is whether you’ll be prepared when they do.

What’s your move going to be?